Momentum Picks 2025: The year 2024 was a positive one for Indian stock markets, with the benchmark Nifty50 index closing with profits for the ninth consecutive year. Nifty50 recorded a profit of 8.80% this year, although it lagged slightly behind broader market indices like Nifty500, which gained 15.16%. But the biggest focus was on Nifty Microcap250, which outperformed all the indices with a spectacular gain of 34.20%. After this, if we talk about Nifty Next50, it registered a gain of 27.45%. This stellar performance made the year 2024 a memorable year for investors.

The data center sector is one of the most promising sectors in the Indian market, which is being boosted by the increase in digital infrastructure and data consumption. Brijesh Bhatia, Senior Research Analyst at Definedge, has told here about two such stocks of this sector, which have a great opportunity to earn profits in 2025. These include Voltas and Amber Enterprises India. Experts believe that these stocks are currently showing a bullish technical setup and may continue to outperform in the coming months.

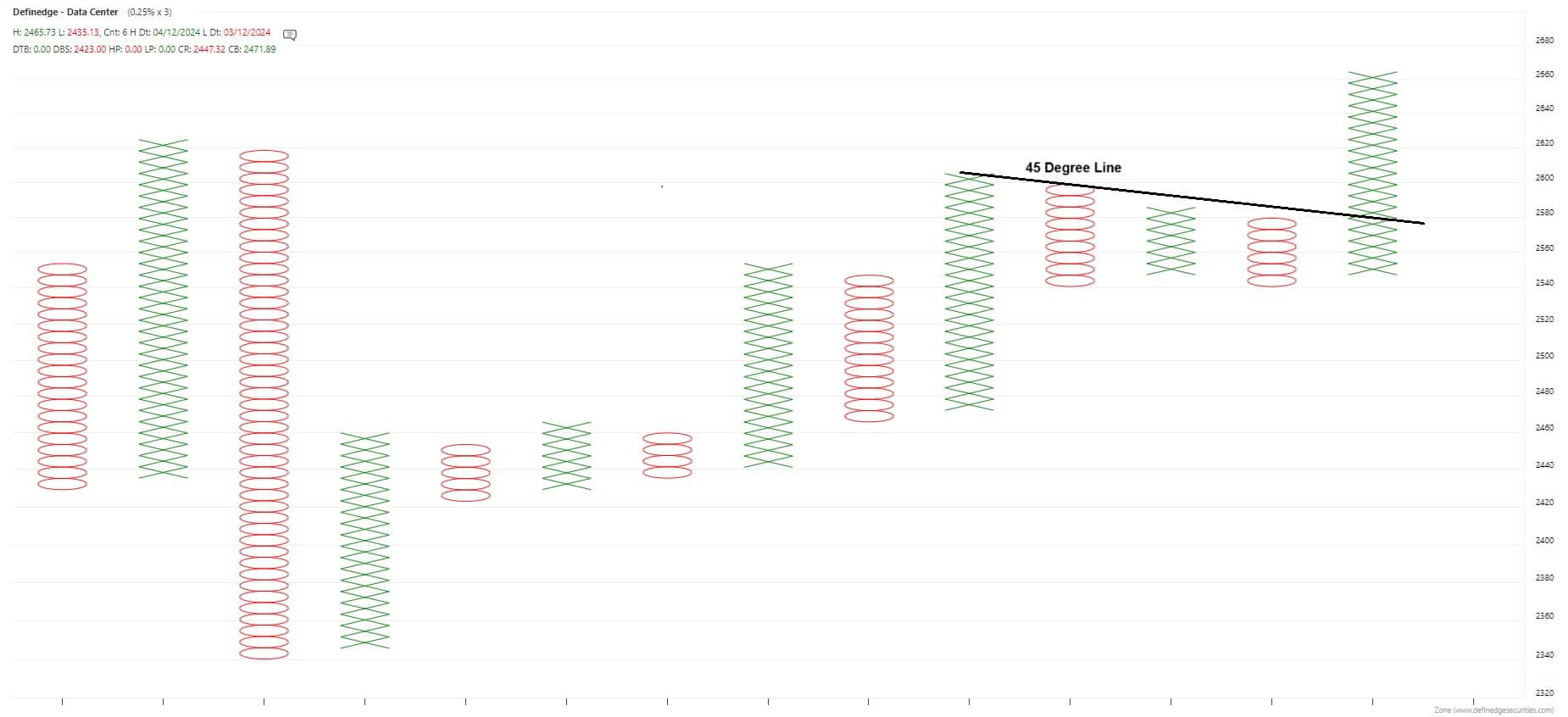

Definedge Data Center Index

With the increasing development of digital services, e-commerce, cloud computing and IoT (Internet of Things), India’s data center industry is at the cusp of a major transformation. The importance of this sector is continuously increasing, but till now there was no dedicated index available for data center related companies. To fill this gap, Definedge Data Center Index has been created. This is an equal-weighted index, which includes 21 companies associated with the data center sector.

Voltas, one of India’s leading cooling solutions companies, has been associated with its air conditioning and refrigeration products for a long time. However, in recent years, Voltas has expanded its reach into the data center sector, particularly in providing critical infrastructure such as cooling solutions for data centers, which is a critical component for their efficient operation.

On the Daily 1% This breakout occurred above the 45-degree trendline, confirming that the price may continue to rise.

A clear support level of ₹1600 is visible in the medium-term charts. If the stock price drops below this level, it will negate the bullish pattern and the market may face weakness. However, if the price continues to move upward, Voltas has the potential to reach new highs. This growth will also be strengthened by the growth in the company’s cooling solutions business and increasing participation in the data center sector.

Amber Enterprises India Limited is another leading company in the Indian cooling solutions market, which primarily provides air conditioning solutions for residential and commercial spaces. However, the company’s strategic focus on expanding into data center cooling and infrastructure services has left it well positioned to take advantage of the rapidly growing data center industry.

On the daily 1% This is a common price action pattern often seen before a big rally in stocks.

Most importantly, the stock is again showing bullish momentum. If the price breaks above ₹7915 level, it will trigger the Anchor Column Follow-Through (AFT) pattern. This pattern indicates a continuation of the upward trend and suggests that Amber Enterprises is well-positioned for growth in the coming quarters.

Disclaimer: The advice or opinions expressed on Moneycontrol.com are the personal views of the expert/brokerage firm. The website or management is not responsible for this. Moneycontrol advises users to always seek the advice of a certified expert before taking any investment decision.