Unlisted Market Boom: Last year 2024 was a great year for investors and shareholders of unlisted companies and companies from different sectors gave strong returns. Tata Capital, Studds Accessories, Nayara Energy, Motilal Oswal Home Finance, Cochin International Airport, NSE and MSEI. Unlisted companies saw tremendous growth. This rise came not only in prices but also in trading activity. Last year was also special in the sense that well-known companies from the unlisted market made a successful entry in the listed market, which increased the interest of investors in the other companies in the unlisted market.

Ajay Garg, Director and CEO of SMC Global Securities, said about the excellent performance of the unlisted market in the year 2024 that last year unlisted stocks gave a return of 27.68% while Nifty 50 gave a return of 11.64% (till January 2, 2025). Monthly trading volume is expected to reach $300 million in 2024, up from $50-60 million in 2023.

Who has entered the listed market and who is in trend in the unlisted market?

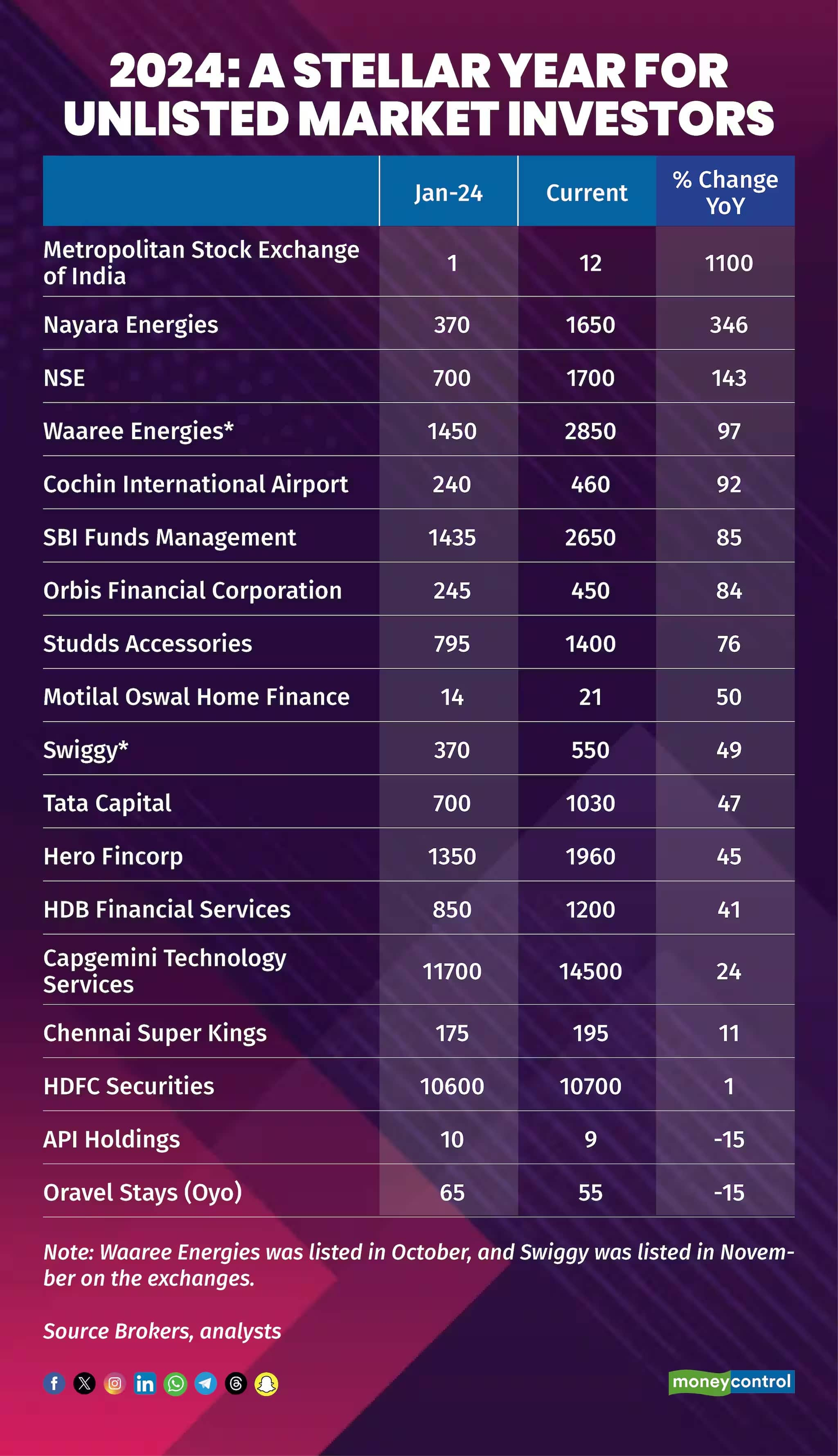

First let us talk about which companies entered the listed space from the unlisted market. The shares of Waari Energies were priced at Rs 1450 in the unlisted market in January 2024, which got listed in October and are currently around Rs 2850. Similarly, the shares of Swiggy were around Rs 370 in the unlisted market in January 2024, which was listed in November 2024 and now it is around Rs 550.

Now let us talk about the currently trading stocks in the unlisted market. Shares of Tata Capital have risen by 47 per cent in a year, Studs Accessories by 76 per cent, Naira Energy by 346 per cent, Motilal Oswal Home Finance by 50 per cent, NSE shares by 143 per cent and Cochin International Airport shares by 92 per cent. The shares of Metropolitan Stock Exchange of India jumped by 1100 per cent and this sharp rise came on the report which revealed that it has raised Rs 238 crore by issuing shares on private placement from many investors including the promoters of Grow and Zerodha.

What do experts say?

Market analysts say that as companies approach their IPO, share prices can go up and down rapidly. During this period, prices rise rapidly but may also fall due to delay or slowdown in IPO activities. To reduce the risk, experts have advised to buy shares only from brokers with strong track record so that any kind of fraud can be avoided.

Prakash Tapse, Senior Vice President and Research Analyst, Mehta Equities, says that returns in the unlisted market are increasing due to increase in demand and trading activities. Activity is increasing as investors are looking for better returns from listed stocks. Investors are trying to take advantage of the low valuation of unlisted shares to maximize returns and overcome the risk of not being allotted shares in the IPO.

Apart from this, it has also got support from the boom in the IPO market. Of the 69 IPOs in FY2024, 51 IPOs were trading above their issue prices, and 10-11 IPOs delivered returns of more than 100%. However, he cautioned investors that investing in unlisted shares before the IPO can yield huge returns but be cautious about high valuation risk and unregulated conditions.

Infosys defers annual pay hike till Q4FY25

Disclaimer: The advice or opinions expressed on Moneycontrol.com are the personal views of the expert/brokerage firm. The website or management is not responsible for this. Moneycontrol advises users to always seek the advice of a certified expert before taking any investment decision.