Market Trade Setup: After a three -day concerted, on June 20, the Nifty witnessed a solid lead and it closed with a rise of 1.29. This led to the decline in the Volatibility Index India VX as well as the weakness perception again. Despite the recovery, the index has been built within a large range of 24,450–25,200 for several weeks. As long as the Nifty continues to trading below 25,200 and the geopolitical tension of the Middle East will remain affecting oil prices, the concertedation and mild correction can continue within a range bound setup. Market experts say that the important support level for Nifty is at 24,700, followed by the next support in the range of 24,500-24,450, which is also its 50-day EMA. The market may occupy the market if it falls down from this important support. Whereas a strong and durable closing above 25,200 can increase.

Here you are giving some such figures on the basis of which you will be able to catch profitable deals.

Support and registration level for nifty

Support based on Pivot Point: 24,876, 24,793 and 24,658

Registration based on Pivot Point: 25,145, 25,229 and 25,363

Bank nifty

Registration based on pivot points: 56,340, 56,520 and 56,811

Support based on pivot points: 55,758, 55,578 and 55,287

Registration based on Fibonacci Retress: 56,643, 57,056

Fibonacci Retress based support: 55,149, 54,820

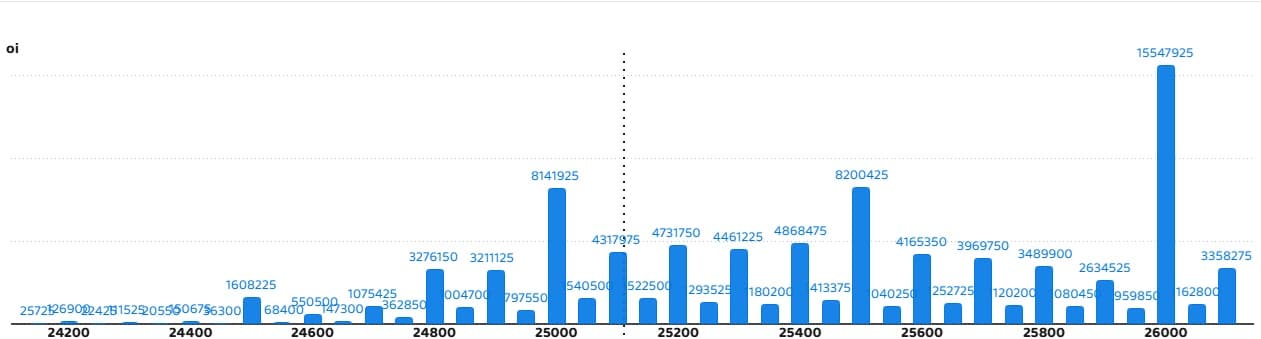

Nifty call option data

A maximum call of 1.55 crore contract has been seen open interest on a strike of 26,000 on the monthly basis, which will work as an important registration level in the upcoming business sessions.

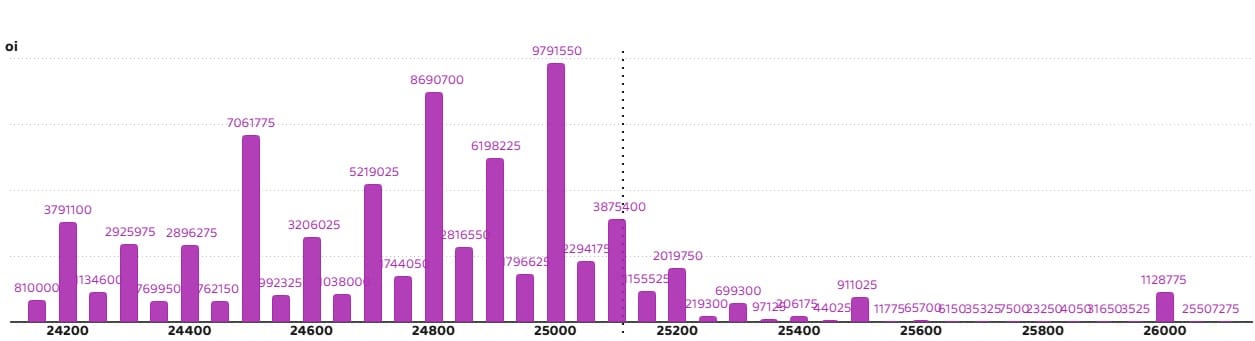

Nifty put option data

On a strike of 25,000, a maximum number of 97.91 lakh contracts have been seen open interest which will work as important support level in the coming business sessions.

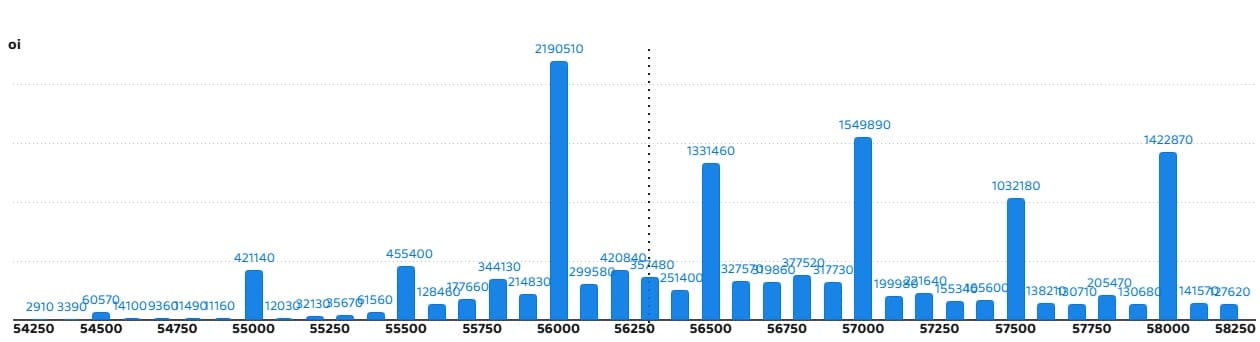

Bank Nifty Call Option Data

Bank Nifty has seen a maximum call open interest of 21.9 lakh contracts on a strike of 56,000, which will work as an important registration level in the upcoming business sessions.

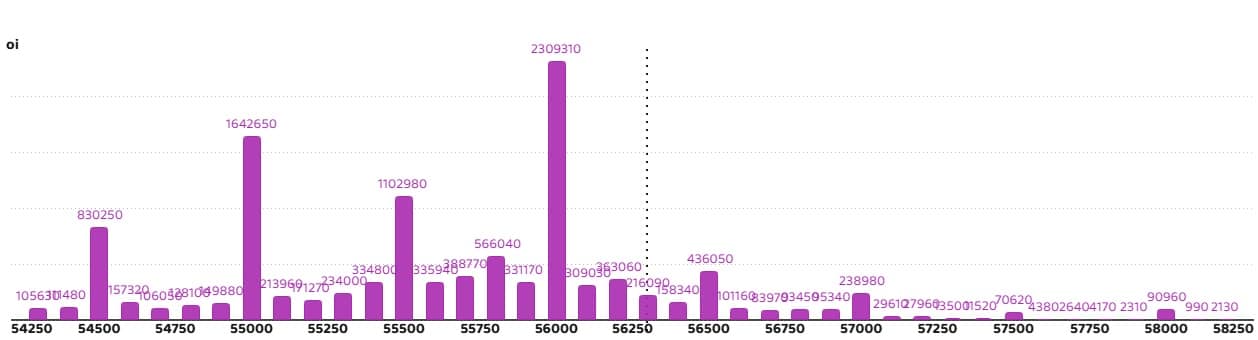

Bank Nifty put option data

On a strike of 56,000, a maximum of 23.09 lakh contracts have been seen open interest, which will work as an important registration level in the coming business sessions.

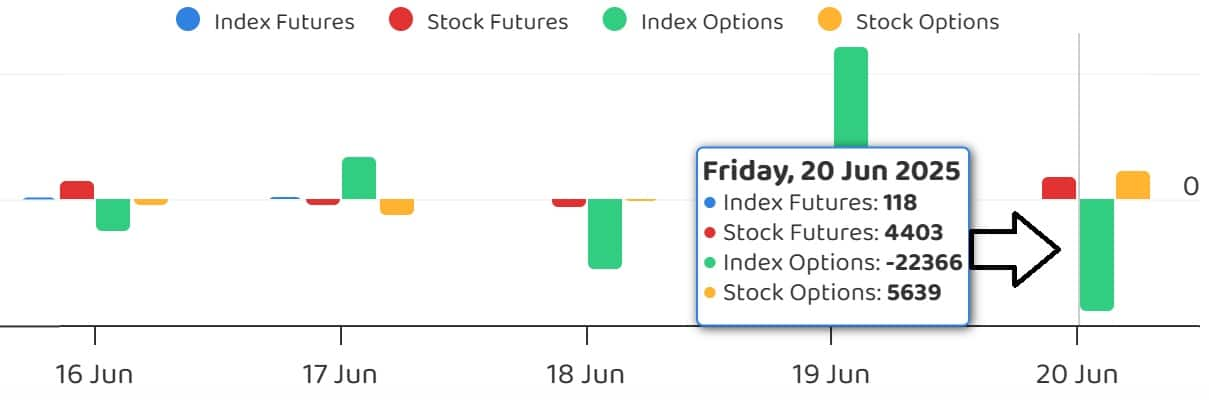

FII and DII Fund Flow

India Vix, which measured the market’s volatility, fell 4.09 per cent to 13.67 on Friday, which gave some relief to the Tejdis. As long as it remains below 15 points, there will be relief for Tejdis. But the bounce above 15 will be a sign of caution.

High delivery trade

Here are the stocks given in which the largest part of the delivery trade was seen. The large part of delivery reflects the interest of investors (unlike trading) in stock.

Long build-up shown in 104 stocks

Along with the increase in open interest, the rise in prices is also usually estimated to become a long position. Based on the Open Interest Future Percentage, 104 shares saw a long build-up in 104 shares.

Long Unwinding seen in 7 Stocks

Along with the fall in open interest, the fall in prices is also usually gauged by long disagreement. Based on the Open Interest Future Percentage, the highest long long long long -term unwinding was seen in 7 shares on the previous trading day.

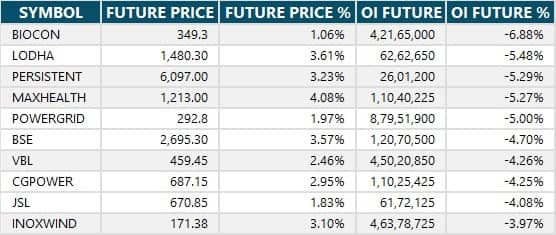

Short build-up shown in 13 stocks

Along with the increase in open interest, the decline in prices is also usually gauged by short build-up. Based on the Open Interest Future Percentage, the highest short build-up was seen in 16 shares on the previous trading day.

Short covering in 100 stocks

Short covering is usually estimated by the rise in open interest as well as the rise in prices. Based on the Open Interest Future Percentage, 92 shares saw the most short covering in 92 shares.

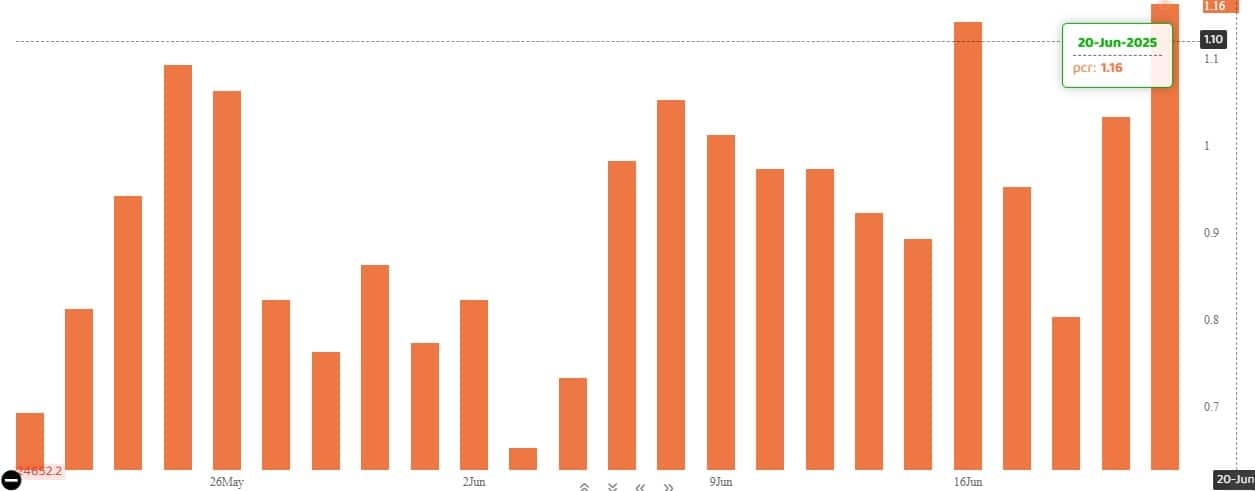

Call call ratio

The Nifty Put-Call Ratio, which depicted the market mood, rose to 1.16 on June 20, while it was at 1.03 levels in the previous session. Significantly, the departure of PCR above 0.7 or 1 cross PCR is generally considered a sign of boom. Whereas the ratio falling below 0.7 or 0.5 is a sign of recession.

Stock under F&O Bain

The F&O segment includes the restricted securities that include the derivative contract market wide position limit to more than 95 per cent.

Stocks involved in F&O ban: nobody

Stocks already involved in F&O ban: Aditya Birla Fashion and Retail, Biocon, RBL Bank, Titagarh Rail Systems

Stocks removed from F&O ban: Central Depository Services, Hoodco, Manappuram Finance

Disclaimer: The ideas given on Moneycontrol.com have their own personal views. The website or management is not responsible for this. Money control advises users to seek the advice of certified experts before taking any investment decision.