Nifty Trade setup: Nifty 50 continued its upward move and maintained higher lows for three consecutive days. Nifty closed with a gain of 0.4 percent on January 16. The index managed to close above November’s lowest level (23,263) and crossed the hurdle of 23,350 intraday. However, the overall sentiment is in favor of recession. Because the index continued to trade well below all major moving averages. Market experts say that the Nifty 50 index is expected to consolidate with immediate support at 23,150. After that the next major support will be 23,050 (January low). In case the uptrend continues, the first resistance is visible at 23,500. Moving above this level, the next resistance will be at the 200-day EMA at 23,680.

Here we are giving you some such figures on the basis of which it will be easy for you to catch profitable deals.

Key support and resistance levels for Nifty (important level 23,312)

Support based on pivot point: 23,280, 23,251 and 23,206

Registration based on pivot point: 23,371, 23,399 and 23,445

Bank Nifty (crucial level 49,279)

Registration based on pivot points: 49,419, 49,519, and 49,679

Support based on pivot points: 49,098, 48,999, and 48,838

Resistance based on Fibonacci retracement: 49,445, 50,410

Support based on Fibonacci retracement: 47,864, 46,078

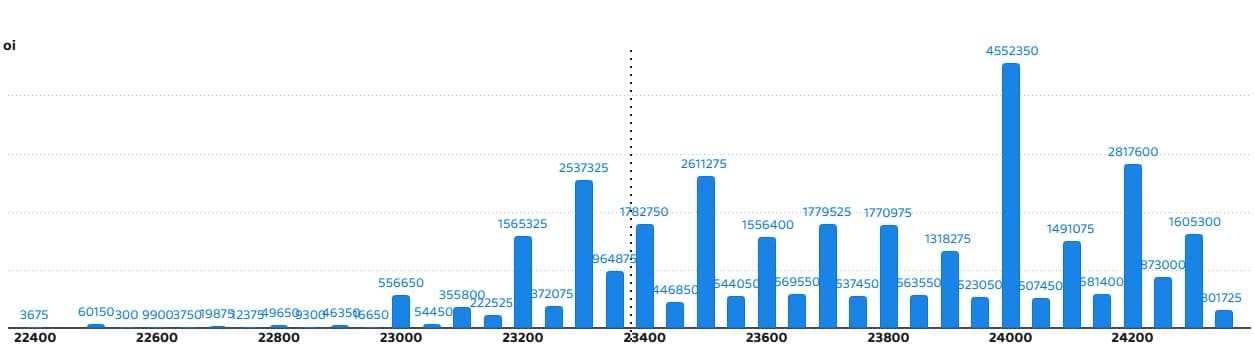

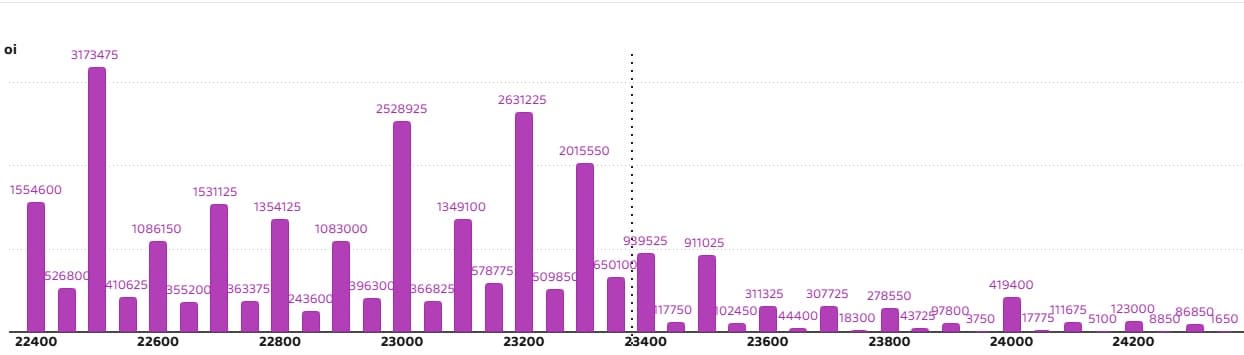

nifty call option date

On monthly basis, maximum call open interest of 45.52 lakh contracts has been seen at the strike of 24,000 which will act as an important resistance level in the coming trading sessions.

nifty put option data

Maximum Put Open Interest of 31.73 lakh contracts has been seen at the strike of 22,500 which will act as an important support level in the coming trading sessions.

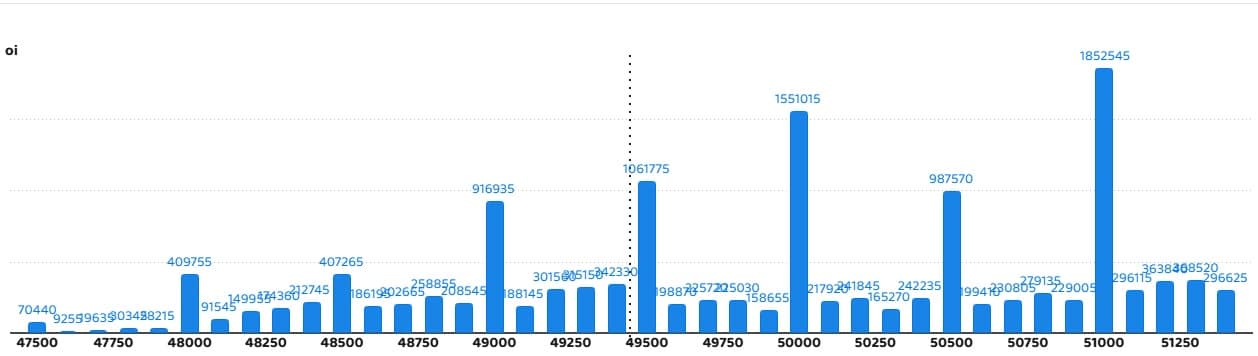

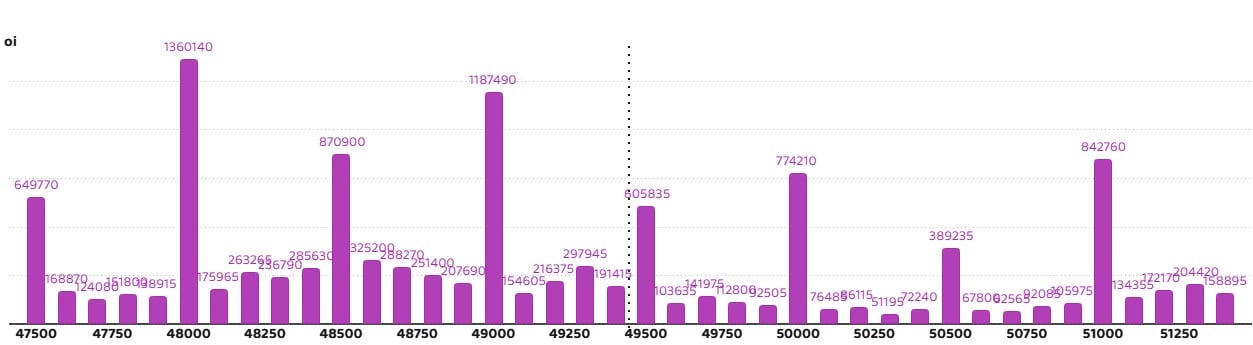

bank nifty call option data

Bank Nifty has seen a maximum call open interest of 18.52 lakh contracts at the strike of 51,000, which will act as an important resistance level in the coming trading sessions.

bank nifty put option data

Maximum Put Open Interest of 13.6 lakh contracts has been seen at the strike of 48,000 which will act as an important resistance level in the coming trading sessions.

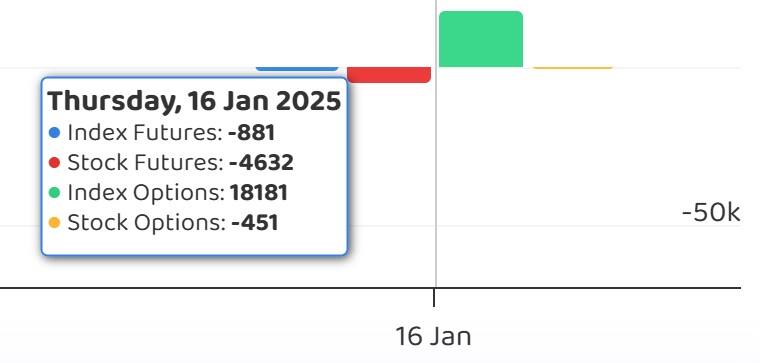

FII and DII fund flows

Volatility index India VIX bounced back after two days of decline. Yesterday it increased by 1.36 percent to reach 15.47. This is a bad situation for the bulls.

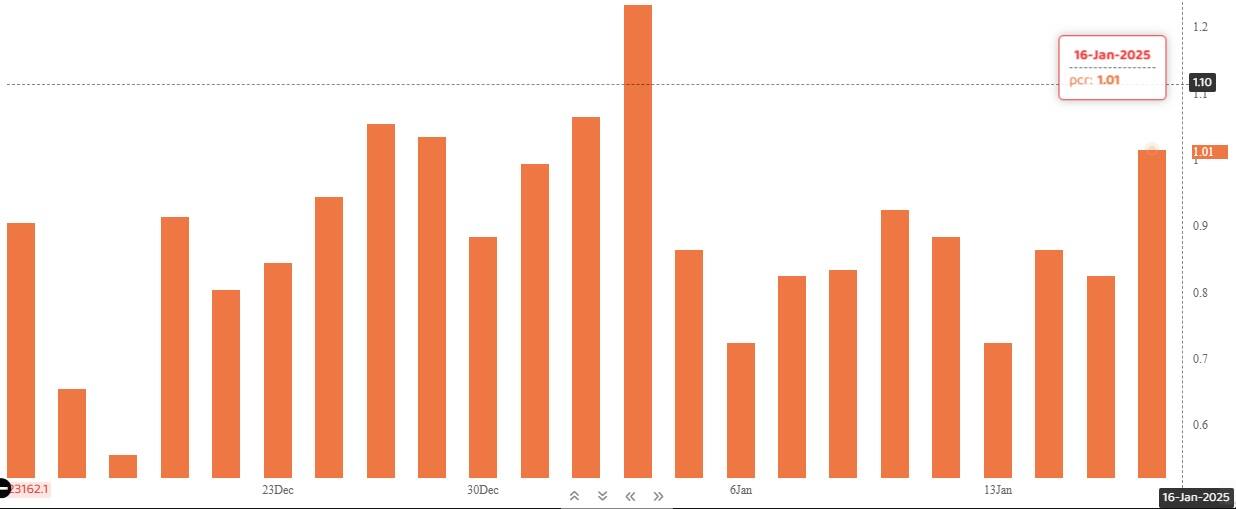

put call ratio

The Nifty Put-Call Ratio (PCR), which reflects the market mood, reached 1.01 on January 16. Whereas in the last session it was at the level of 0.82. It is noteworthy that PCR going above 0.7 or crossing 1 is generally considered a sign of bullish sentiment. Whereas a ratio falling below 0.7 or towards 0.5 indicates bearish sentiment.

Stocks covered under F&O ban

Restricted securities under the F&O segment include those companies whose derivative contracts exceed 95 per cent of the market wide position limit.

RIL Q3 Results: Income increased from Rs 2.25 lakh crore to Rs 2.40 lakh crore, profit was Rs 18540 crore.

Newly included stocks in F&O ban: nobody

Stocks already included in F&O restrictions: Aarti Industries, Aditya Birla Fashion & Retail, Angel One, Bandhan Bank, Hindustan Copper, Kalyan Jewellers, L&T Finance, Manappuram Finance, RBL Bank

Stocks removed from F&O ban: nobody

Disclaimer: The views expressed on Moneycontrol.com are the personal views of the experts. The website or management is not responsible for this. Money Control advises users to seek the advice of a certified expert before taking any investment decision.