Market Trade Setup: On 4 February, the Nifty made a rapid return with a gap-up opening and recorded a rise of 1.6 per cent. Yesterday the Nifty closed at a one -month high. Strong registration trendline brakeouts and strong closing of 50 and 200-day EMAs by Nifty have confirmed the end of the previous lower highs lower loz formation. In such a situation, if the index remains above 23,600 (200-day EMA), a rally cannot be ruled out in the upcoming business sessions. However, market experts also say that there is a possibility of instant at 23,550, followed by the next major support at 23,360 (10 or 20-day EMA).

Here you are giving some such figures on the basis of which you will be able to catch profitable deals.

Support and resistance level for nifty

Support based on Pivot Point: 23,512, 23,432 and 23,302

Resistance based on Pivot Point: 23,771, 23,852 and 23,981

Bank nifty

Resistance based on pivot points: 50,226, 50,396, and 50,673

Support based on pivot points: 49,672, 49,502, and 49,225

Resistance based on Fibonacci Retress: 50,369, 51,162

Fibonacci Retress based support: 47,875, 46,078

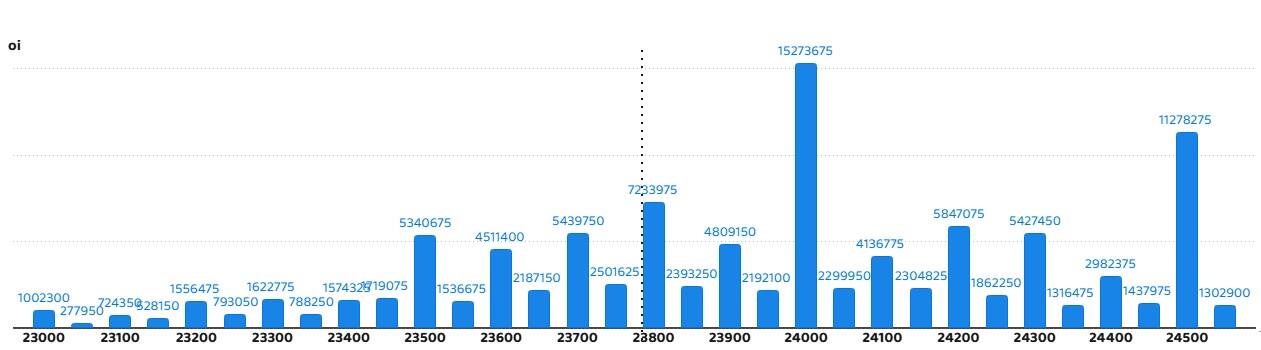

Nifty call option data

A maximum call of 1.52 crore contract has been seen open interest on a strike of 24,000 on the monthly basis, which will work as an important registration level in the coming business sessions.

Nifty put option data

On a strike of 23,000, a maximum number of open interest of 1.24 crore contracts has been seen which will work as important support level in the coming business sessions.

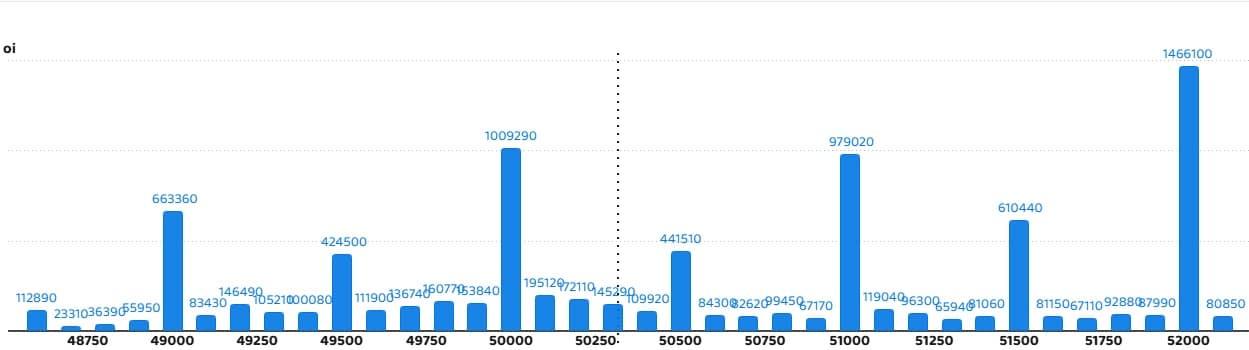

Bank Nifty Call Option Data

Bank Nifty has seen a maximum call open interest of 14.66 lakh contracts on a strike of 52,000, which will work as important registration levels in the coming business sessions.

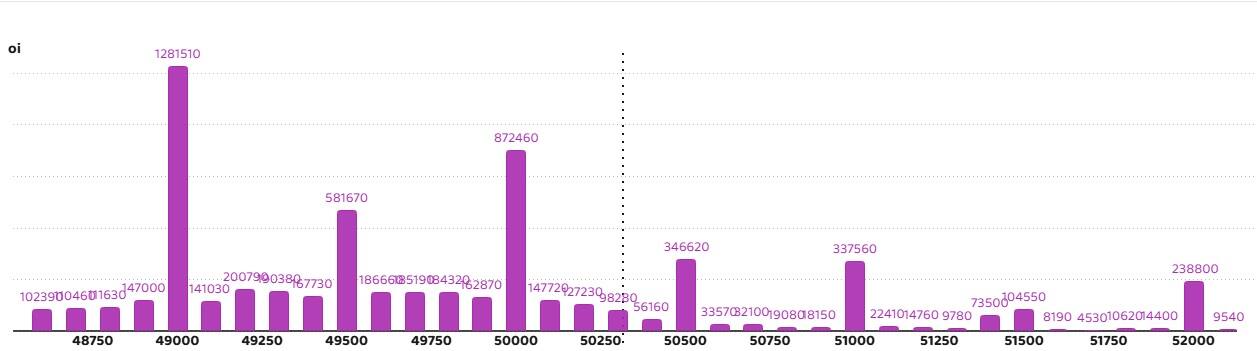

Bank Nifty put option data

On a strike of 49,000, a maximum of 12.81 lakh contracts have been seen open interest, which will work as important registration levels in the coming business sessions ahead.

Delhi Chunav Live: Voting continues in Delhi, Sandeep Dixit and Alka Lamba cast their vote

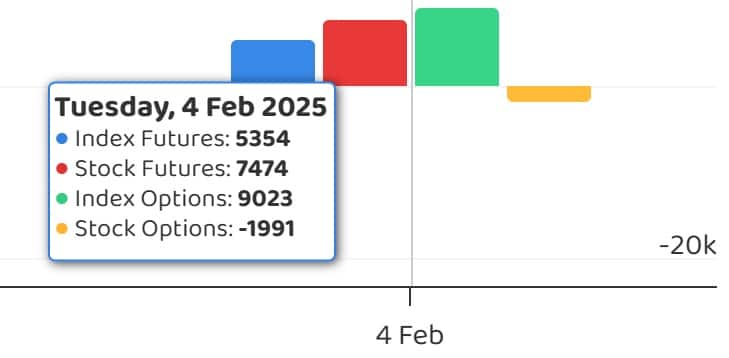

FII and DII Fund Flow

The Volatibility Index India Vix was at the lower level yesterday. It fell 2.33 percent to 14.02. Which is its lowest closing level after 3 January. This gave further relief to the stunnings.

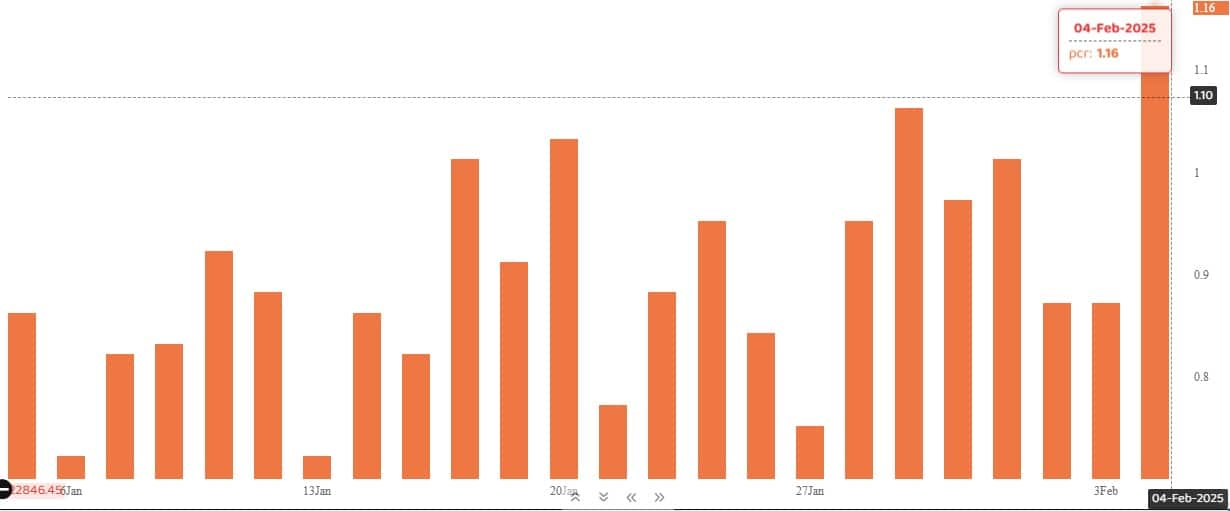

Call call ratio

The Nifty Put-Call Ratio, which depicted the market mood, rose to 1.16 on February 04. At the same time, it was at the level of 0.87 on the last trading day. Significantly, the departure of PCR above 0.7 or 1 cross PCR is generally considered a sign of boom. Whereas the ratio falling below 0.7 or 0.5 is a sign of recession.

Stock under F&O Bain

The F&O segment includes the restricted securities that include the derivative contract market wide position limit to more than 95 per cent.

Stock involved in F&O ban: nobody

Stocks already involved in F&O ban: nobody

Stocks removed from F&O ban: nobody

Disclaimer: The ideas given on Moneycontrol.com have their own personal views. The website or management is not responsible for this. Money control advises users to seek the advice of certified experts before taking any investment decision.