Market Trade Setup: In the early 5 February businessman, Nifty crossed the downward Redstance Trendline by going above 23,800. But this level could not retain the level between increased volatility due to profits. On 5 February, the Nifty closed down 43 points. It is a sign like a stay to breathe after a day of rapid bounce. However, with the formation of higher tops and higher bottles on the daily chart, the overall trend remains in favor of the fast. In such a situation, market experts are advising to shop on every decline. He says that if the index decisively goes above 23,800, then the possibility of increasing rapidly towards 24,000-24,200 cannot be ruled out. But the next support will be at 23,500 when going below 23,800

Here you are giving some such figures on the basis of which you will be able to catch profitable deals.

Support and resistance level for nifty

Support based on Pivot Point: 23,680, 23,650 and 23,601

Resistance based on Pivot Point: 23,776, 23,806 and 23,855

Bank nifty

Resistance based on pivot points: 50,477, 50,550, and 50,667

Support based on pivot points: 50,243, 50,171, and 50,054

Resistance based on Fibonacci Retress: 51,152, 51,937

Fibonacci Retress based support: 47,875, 46,078

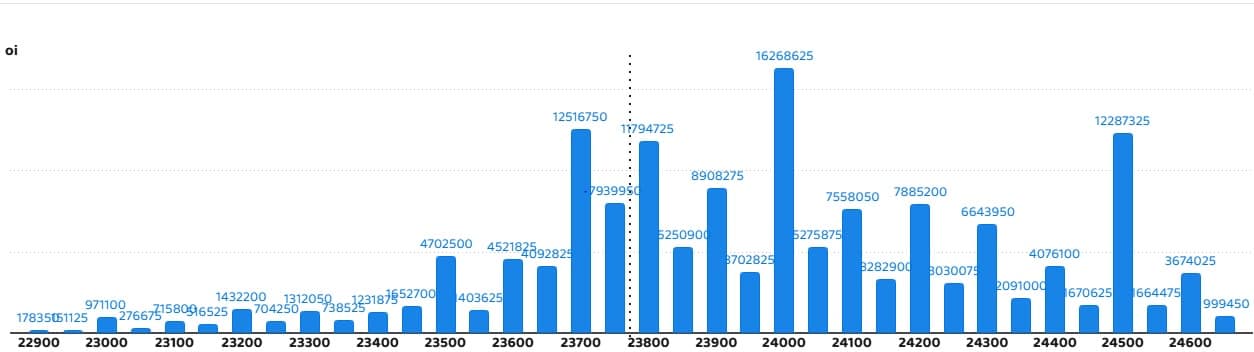

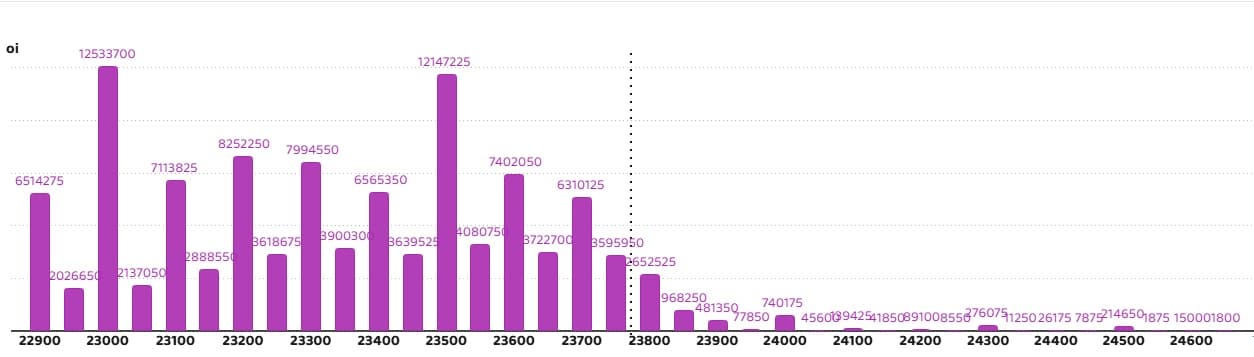

Nifty call option data

A maximum call of 1.62 crore contract has been seen open interest on a strike of 24,000 on a weekly basis, which will work as important registration level in the coming business sessions.

Nifty put option data

On a strike of 23,000, a maximum number of open interest of 1.25 crore contracts has been seen which will work as important support level in the coming business sessions.

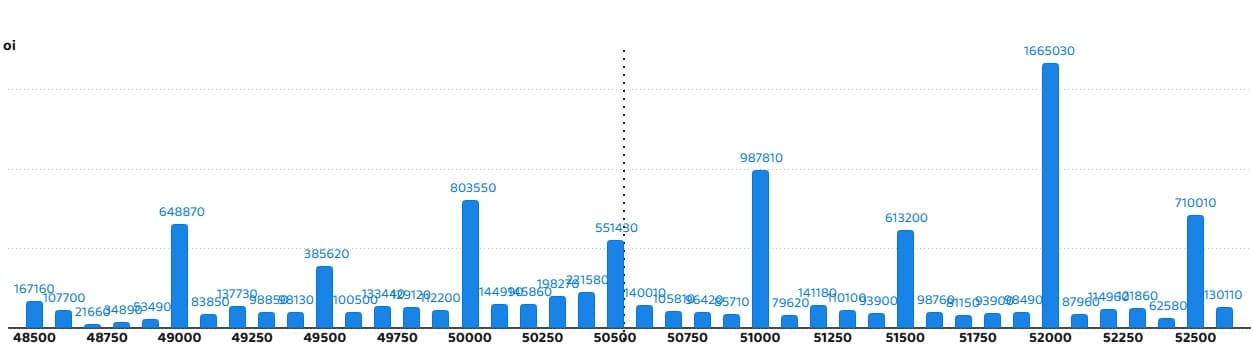

Bank Nifty Call Option Data

The bank Nifty has seen a maximum call open interest of 16.65 lakh contracts on a strike of 52,000, which will work as important registration levels in the upcoming business sessions.

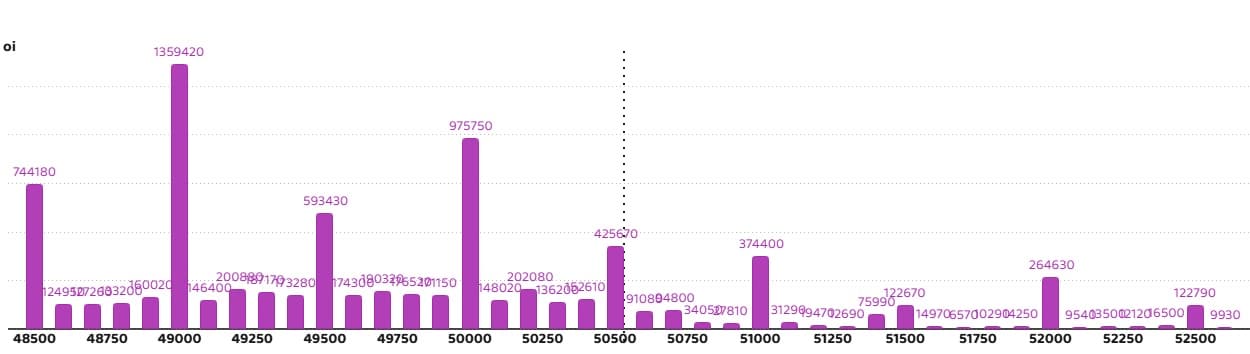

Bank Nifty put option data

On a strike of 49,000, a maximum of 13.59 lakh contracts have been seen open interest, which will work as important registration levels in the coming business sessions ahead.

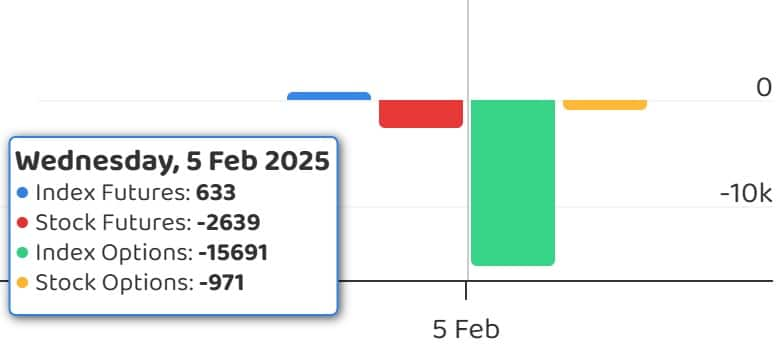

FII and DII Fund Flow

Fear Index India VIX reached 14.08 with a slight gain of 0.46 per cent. But it is made below all the major moving averages and in the lower zone. This is providing relief to the sharpness.

Experts Views: Market short -term trend positive, buy shares with strong fundamentals in any fall

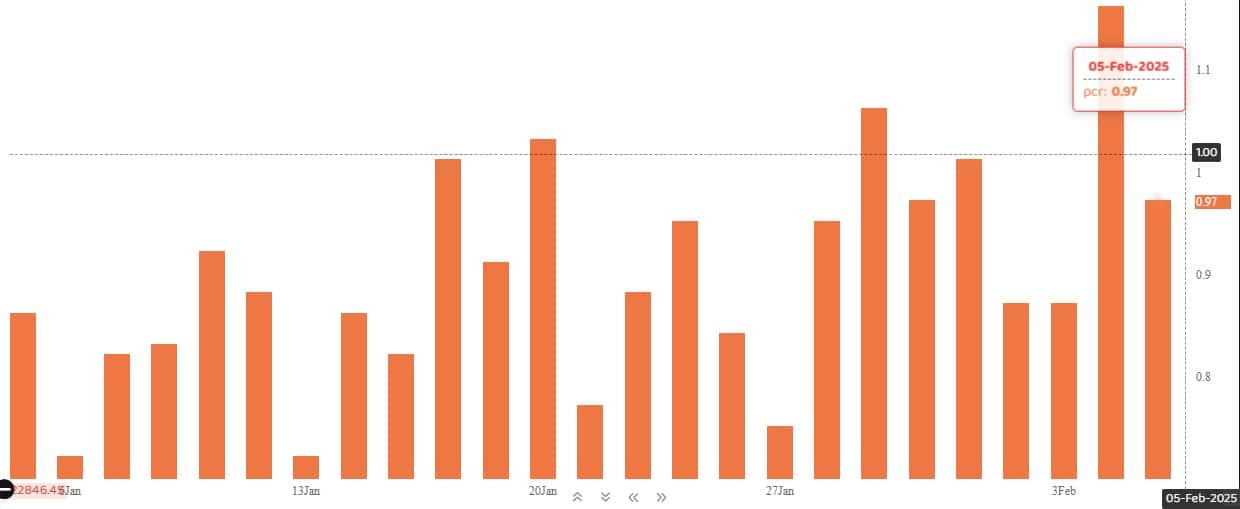

Call call ratio

The Nifty Put-Call Ratio (PCR), which showed the market mood, declined to 0.97 on February 5, compared to 1.16 in the previous season. Significantly, the departure of PCR above 0.7 or 1 cross PCR is generally considered a sign of boom. Whereas the ratio falling below 0.7 or 0.5 is a sign of recession.

Stock under F&O Bain

The F&O segment includes the restricted securities that include the derivative contract market wide position limit to more than 95 per cent.

Stocks involved in F&O ban: nobody

Stocks already involved in F&O ban: nobody

Stocks removed from F&O ban: nobody

Disclaimer: The ideas given on Moneycontrol.com have their own personal views. The website or management is not responsible for this. Money control advises users to seek the advice of certified experts before taking any investment decision.