Market Trade Setup: Equity markets continued to decline in the fourth consecutive carbor session on 10 February. The benchmark Nifty declined by 178 points. On the third day, it has maintained the pattern of lower tops and lower bottoms. But it managed to defend the midline of the Bollinger band located around 23,300. Market experts say that if the Nifty 50 index is successful in retaining 23,300 levels, then it may face resistance within the radius of 23,450-23,500, after which there will be the next increased resistance on 23,600 (200-day EMA). However, when the level of 23,300 is broken, it can fall to 23,200 (low -level of 3 February), which is its important support level.

Here you are giving some such figures on the basis of which you will be able to catch profitable deals.

Support and registration level for nifty

Support based on Pivot Point: 23,326, 23,266 and 23,170

Registration based on Pivot Point: 23,519, 23,578 and 23,674

Bank nifty

Registration based on pivot points: 50,119, 50,226, and 50,399

Support based on pivot points: 49,774, 49,667, and 49,494

Registration based on Fibonacci Retress: 50,380, 51,149

Fibonacci Retress based support: 49,286, 47,866

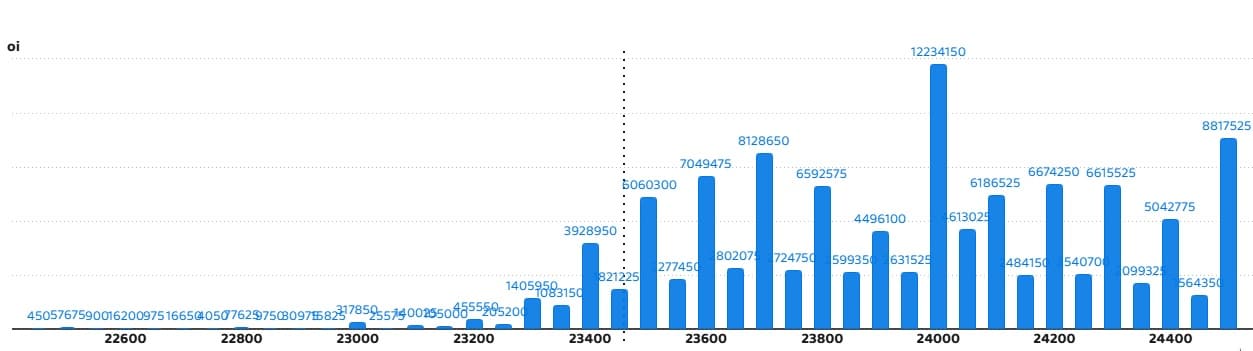

Nifty call option data

A maximum call of 1.22 crore contract has been seen open interest on a strike of 24,000 on a weekly basis, which will work as an important registration level in the coming business sessions.

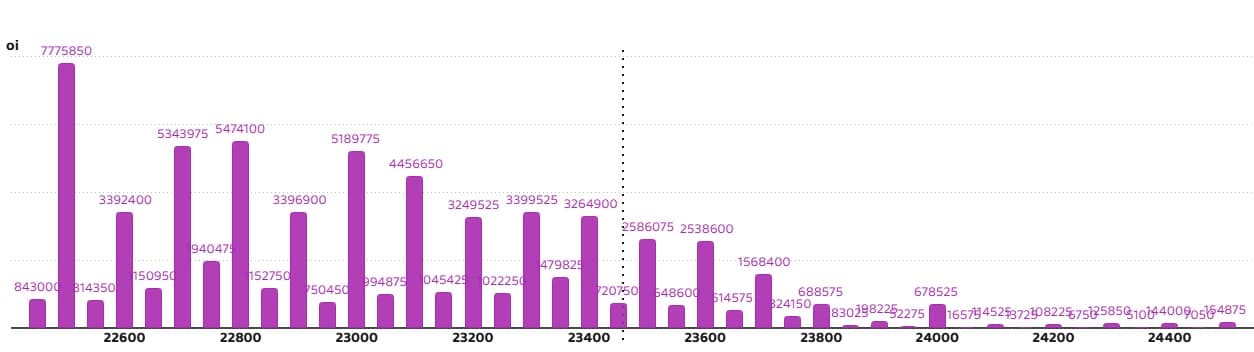

Nifty put option data

A maximum of 77.75 lakh contracts have been seen open interest on a strike of 22,500, which will work as important support level in the coming business sessions.

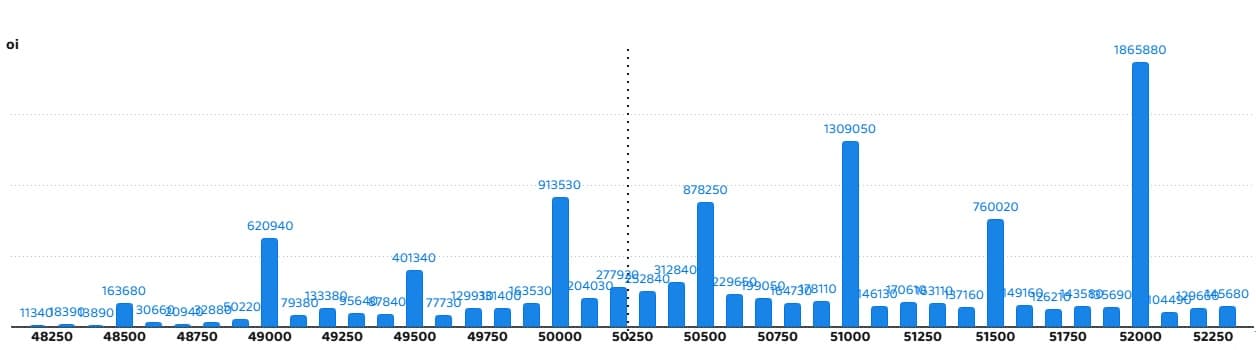

Bank Nifty Call Option Data

Bank Nifty has seen a maximum call open interest of 18.65 lakh contracts on a strike of 52,000, which will work as an important registration level in the upcoming business sessions.

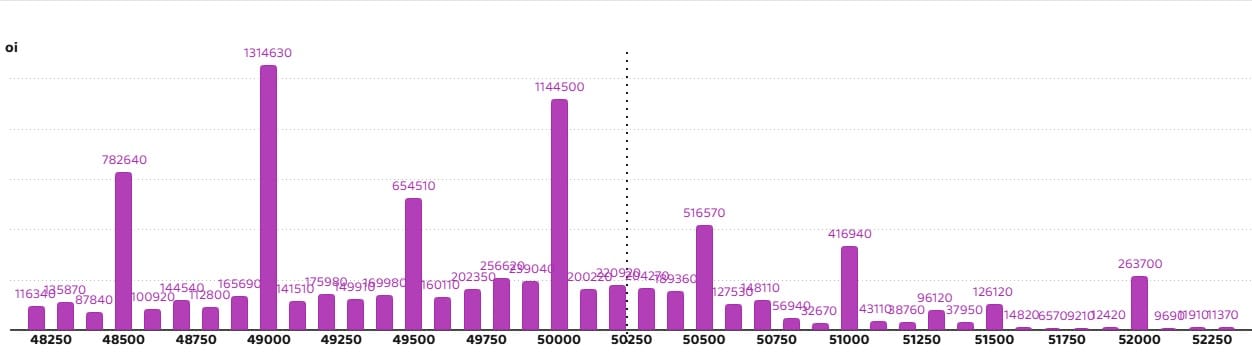

Bank Nifty put option data

On a strike of 49,000, a maximum of 13.14 lakh contracts have been seen open interest, which will work as important registration levels in the coming business sessions.

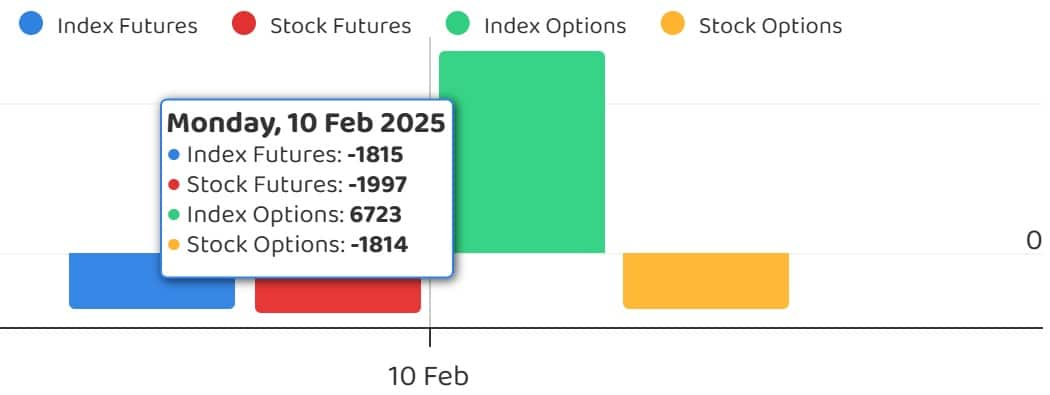

FII and DII Fund Flow

The Voltyness Index, India VIX reached 14.44 with a jump of 5.55 per cent. This is a bad sign for sharpness. However, it remains within a small range from the last six consecutive sessions.

Stock Market Live Updates: Gift Nifty is indicating, Indian market can be started

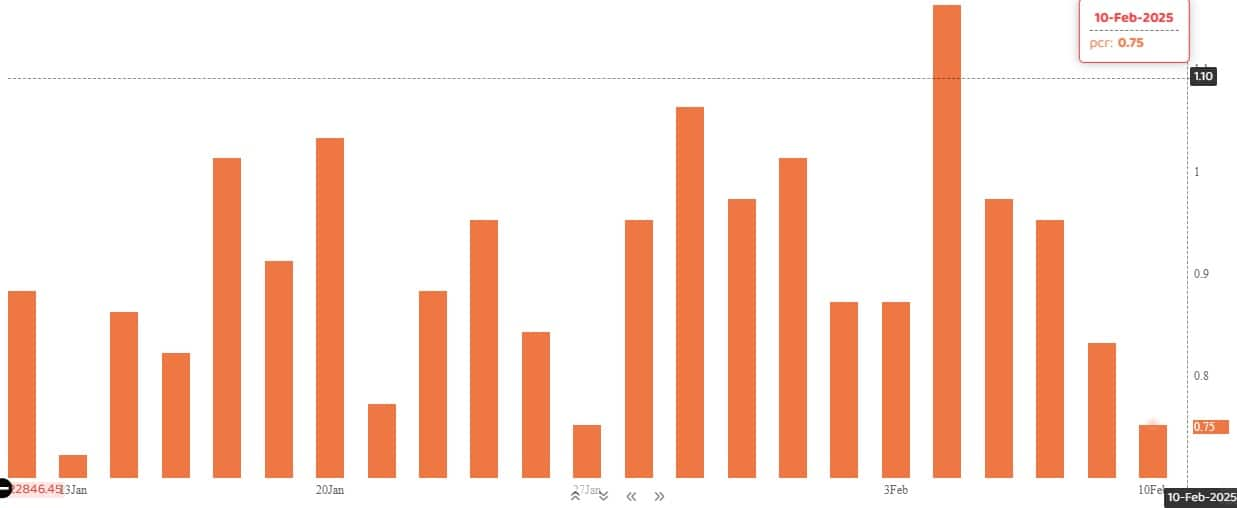

Call call ratio

The Nifty Put-Call Ratio, which depicted the market mood, fell at 0.75 on 10 February, compared to 0.83 in the previous session. Significantly, the departure of PCR above 0.7 or 1 cross PCR is generally considered a sign of boom. Whereas the ratio falling below 0.7 or 0.5 is a sign of recession.

Stock under F&O Bain

The F&O segment includes the restricted securities that include the derivative contract market wide position limit to more than 95 per cent.

Stocks involved in F&O ban: nobody

Stocks already involved in F&O ban: Manappuram Finance

Stocks removed from F&O ban: nobody

Disclaimer: The ideas given on Moneycontrol.com have their own personal views. The website or management is not responsible for this. Money control advises users to seek the advice of certified experts before taking any investment decision.