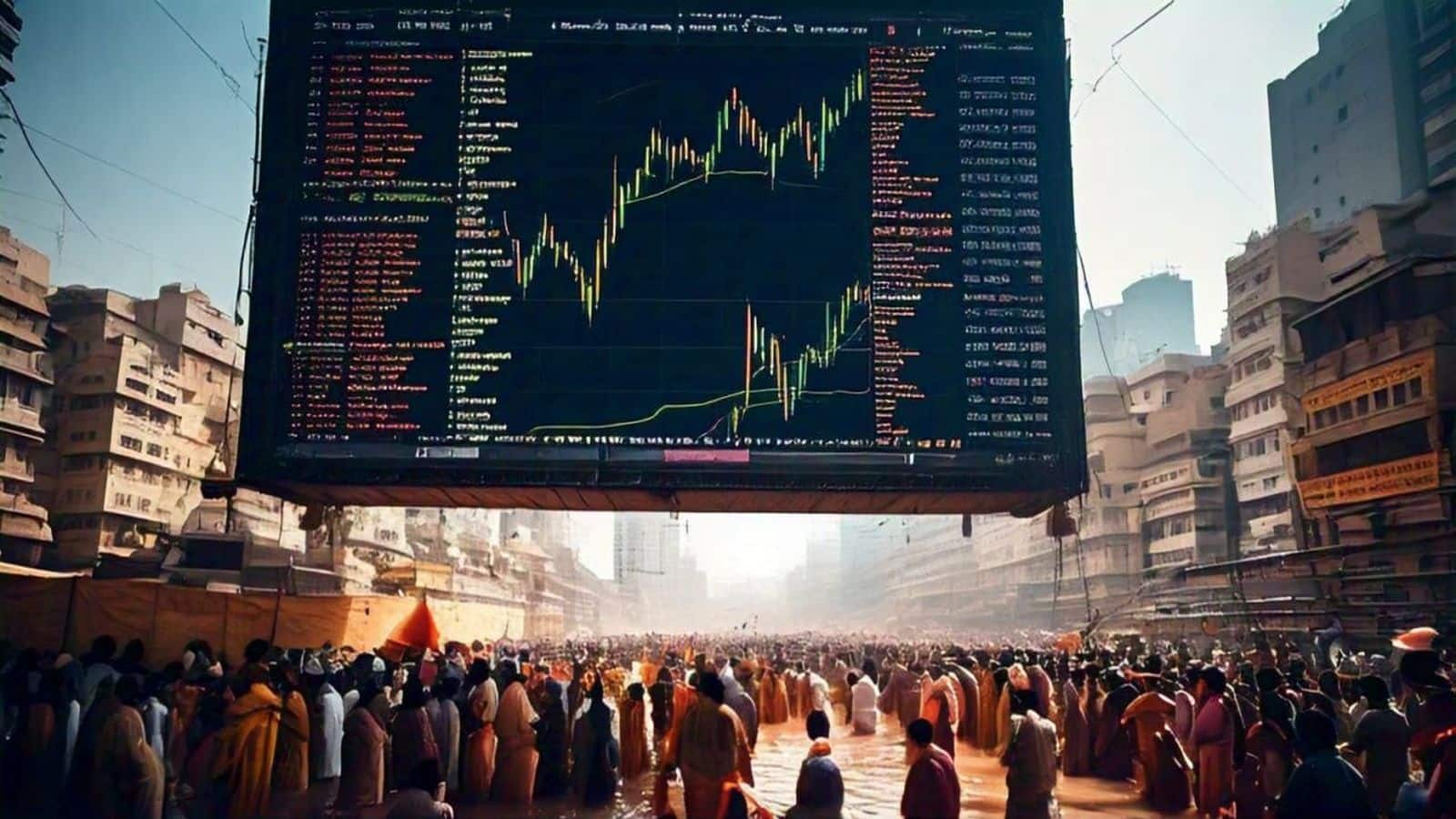

Kumbh Mela and Sensex: The world’s largest religious event ‘Maha Kumbh Mela’ has started today from January 13 in Prayagraj, Uttar Pradesh. Lakhs of devotees are taking a dip in the river Ganga. Meanwhile, an interesting report has come out linking Kumbh Mela with the stock market. In this report, citing old data, it has been said that not only the devotees, but also the stock market takes a dip during the Kumbh Mela. Whenever Kumbh Mela has been organized in the last 20 years, BSE Sensex has given negative returns during that period. This report was prepared by Apoorva Sheth of SAMCO Securities.

He told that since 2004, Kumbh Mela has been organized a total of 6 times. And Sensex has given negative returns on all these occasions. The average duration of the Kumbh Mela is 52 days and according to the data of the last 6 fairs, the Sensex has recorded an average decline of 3.42% during this period.

For example, in the 2021 Kumbh Mela, which ran in Haridwar from April 1 to April 19, 2021, the Sensex fell by 4.16% in this nearly 18-day period. The largest decline was during the 2015 Kumbh Mela, which ran from 14 July to 28 September 2015 in Nashik. The Sensex had fallen by 8.29% during this period. Whereas during the 2004 Ujjain Kumbh Mela, from April 5 to May 4, there was a decline of 3.29% during about 29 days.

The 2010 Haridwar Kumbh Mela ran from January 14 to April 28 and during this period the Sensex fell by 1.16 percent. This is the lowest decline in the last 6 Kumbh Melas. Earlier, Kumbh had taken place in Prayagraj in 2013, which ran from January 14 to March 11 and during this period the Sensex had fallen by 1.31 percent.

The report states that “Kumbh Mela also gives an opportunity to the stock market investors to correct their mistakes and make a new beginning. During the bull market, investors often make many mistakes in order to earn quick profits. But unfortunately, investors do not realize their mistakes until there is a correction or fall in the market. Similarly, this fall also becomes a problem for the investors. Works like a ‘reset’.”

The interesting thing is that during the Kumbh Mela, there is a fall in the Sensex, but after that there is a rise in the market. Six months after the end of Kumbh, the Sensex has given positive returns on five out of the last six occasions and its average return during this period has been 8%, which is a very good return in itself.

There could be many reasons behind this strange trend in the stock market during and after Kumbh. Apoorva Seth said that lakhs of Indians participate during the Kumbh Mela. Due to this, there may be a temporary change in the consumption pattern and economic activity may also reduce in some sectors. It may also have an impact on the stock market. Apart from this, such festivals take people away from illusion and towards their roots, which may unknowingly influence the risk taking idea of investors.

The Kumbh Mela is organized on the basis of the 12-year cycle of the planet Jupiter and its planetary position. This indicates that like human behavior, stock market movements are sometimes influenced by factors other than economic logic. In such a situation, investors should always be cautious in the stock market.

Also read- Shriram Finance Share: Great opportunity to earn 35% profit, this is the opinion of brokerage

Disclaimer: The views and investment advice given by experts/brokerage firms on Moneycontrol are their own and not those of the website and its management. Moneycontrol advises users to consult certified experts before taking any investment decision.