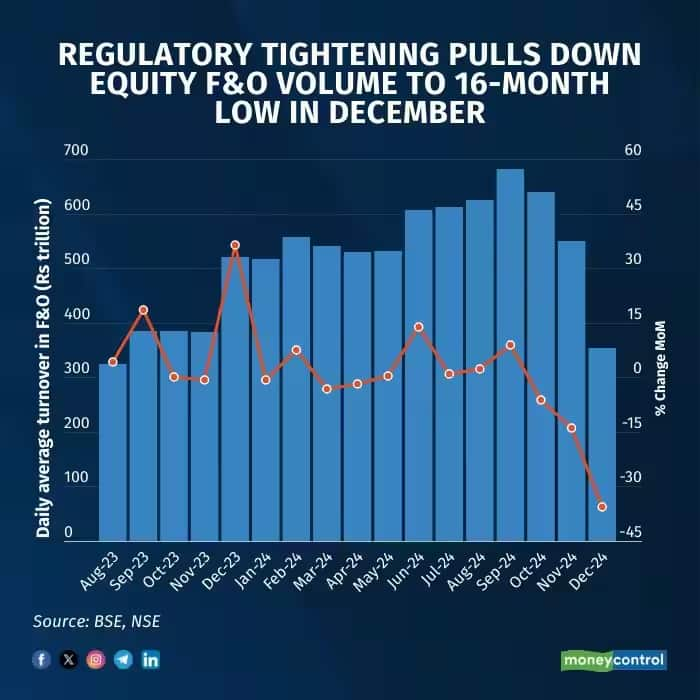

SEBI’s crackdown on curbing speculative trading and reducing retail participation is weighing heavily on the market. Average daily turnover (ADTV) in the equity derivatives segment fell to a 16-month low in December. In contrast, cash market turnover, which was falling for five consecutive months, increased by 4.4 percent on a monthly basis in December. In the month of December, ADTV in the F&O segment on BSE and NSE fell to Rs 280 lakh crore, which is the lowest since August 2023 and 36.56 percent less than November 2024. Most importantly, if we compare the volume in the month of December with the figures of September, there is a decline of up to 48 percent. Index futures turnover fell for the second consecutive month, while stock futures, index options and stock options declined for the third consecutive month.

What do experts have to say on the declining trend of traders?

To protect retail traders from rising losses, SEBI introduced larger contract sizes, increased margins and reduced the number of products traded. Due to this the trading volume reduced. Apart from this, due to uncertainties at the global level and huge fluctuations in the domestic market, traders adopted a cautious attitude and due to this the participation in the derivatives market reduced. According to Shrey Jain, Founder and CEO of SAS Online, due to the new rules of market regulator SEBI, traders are being cautious and there was a big decline in business in the derivatives segment. He says that for weekly derivatives, larger contract sizes are being introduced from January 1, which may reduce the trading volume further.

What do experts have to say about the increase in cash turnover?

Turnover in the derivatives segment decreased in December, but cash market turnover, which was declining for five consecutive months, increased by 4.4 percent on a monthly basis in December. Akshay Chinchalkar, Head of Research, Axis Securities, gives two reasons for this. He says that the impressive listings of the IPO have increased the interest of investors. Apart from this, same-day settlement regulation is going to be implemented in top 500 stocks from January 31, 2025, this has also made the environment positive. Narinder Wadhwa, MD and CEO of SKI Capital, believes that the increase in cash market turnover reflects a strategic shift by investors, who are looking for safe options amid huge market fluctuations.

Gainers & Losers: Green start of the year 2025, make big money instantly from these shares in intra-day

Disclaimer: The advice or opinions expressed on Moneycontrol.com are the personal views of the expert/brokerage firm. The website or management is not responsible for this. Moneycontrol advises users to always seek the advice of a certified expert before taking any investment decision.