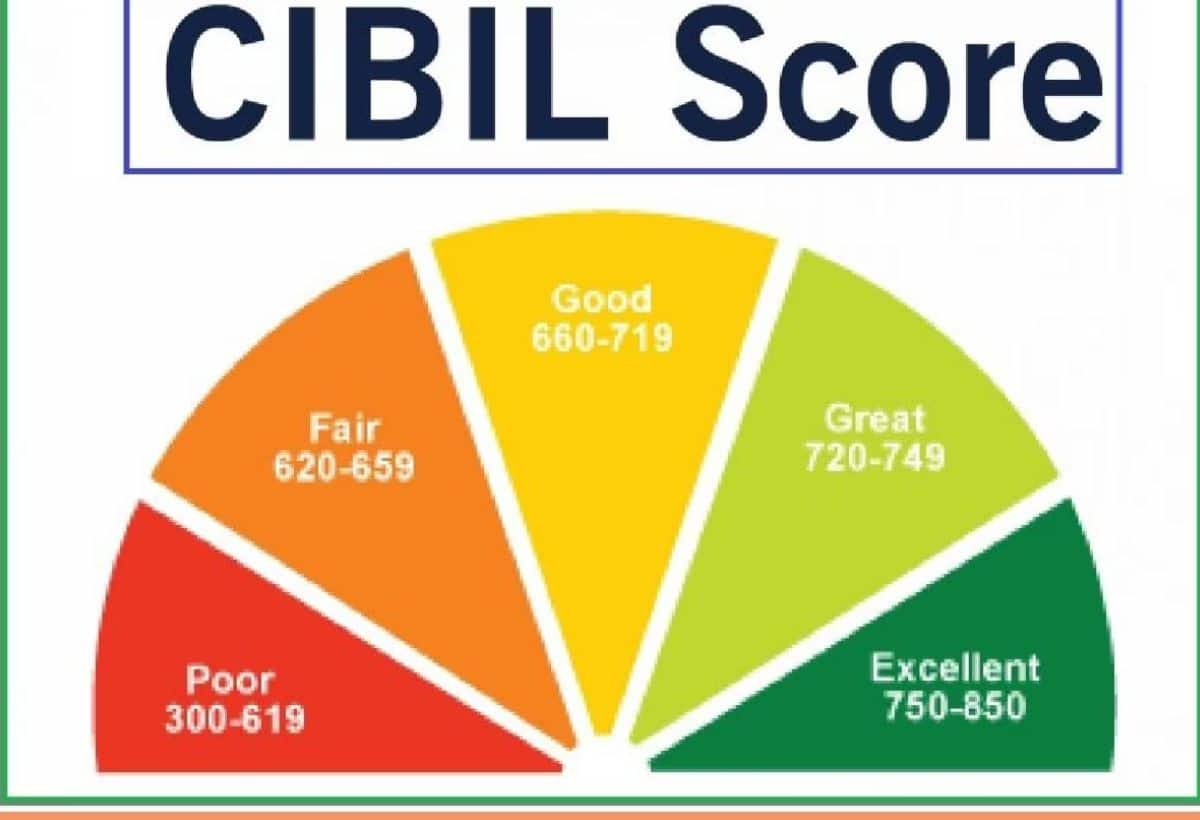

Credit Score: Credit score is an important measure of your financial health. If this score is reduced, then not only does it face problems in getting new loans, but the credit card limit can also be reduced. Especially if you have not filled or missed the EMI of the home loan, then your score can fall from 50 to 100 points. Its direct effect will be that it can be difficult for you to take a loan in the future.

EMI missing disadvantages

If someone’s credit score is more than 750 and he misses an EMI, his score may fall to about 100 points. At the same time, the decline can be even more serious for those whose score is already below 700. Apart from this, missing EMI has to be paid late fees, fine and additional interest. This penalty is usually 1 to 2 percent of the outstanding amount.

How to improve credit score

If you have missed an EMI, first fill it as soon as possible. The longer you do to repay the loan, the more your score will fall. To avoid this problem, adopt an option of auto-debit facility, so that EMI is cut automatically every month.

Also, you can set a reminder on the mobile calendar or link EMI to your salary account so that the payment is on time.

Avoid taking new loans

Until your old outstanding amount is completely repaid, new loans should be avoided. This may worsen your financial condition.

Credit card related to fixed deposits

If you want to improve your credit score quickly, you can take a low-limit or secured credit card, which is given in exchange for fixed deposits. Make a complete payment of this card every month, which will strengthen your payment history and will also slowly improve the score.