The broader index performed according to the benchmark Indzex. The mixed quarterly results, the continuous selling from the FII, the US President’s uncertain tariff policies saw the unstable markets and for the first time in nearly five years, there was instability in the interest rate cuts by the RBI. The BSE Smallcap index closed with a slight increase, which broke the fall of 4 weeks. While BSE midcap and largecap indexes recorded an edge. The second week also continued to increase.

This week the BSE Sensex rose 354.23 points or 0.45 percent to close at 77,860.19, while the Nifty 50 index rose 77.8 points or 0.33 percent to close at 23,559.95. In terms of sector, the BSE FMCG index declined by more than 5 per cent, the BSE Realty Index fell by 3.5 per cent, the BSE Capital Goods index fell by 2.4 per cent, the BSE power index fell by about 2 per cent. Although BSE Healthcare increased by 3 per cent, the BSE metal index gained nearly 3 per cent, BSE Information Technology recorded an increase of about 2 per cent.

Us Markets: Wall Street closed with decline due to increase in trade and weak economic figures

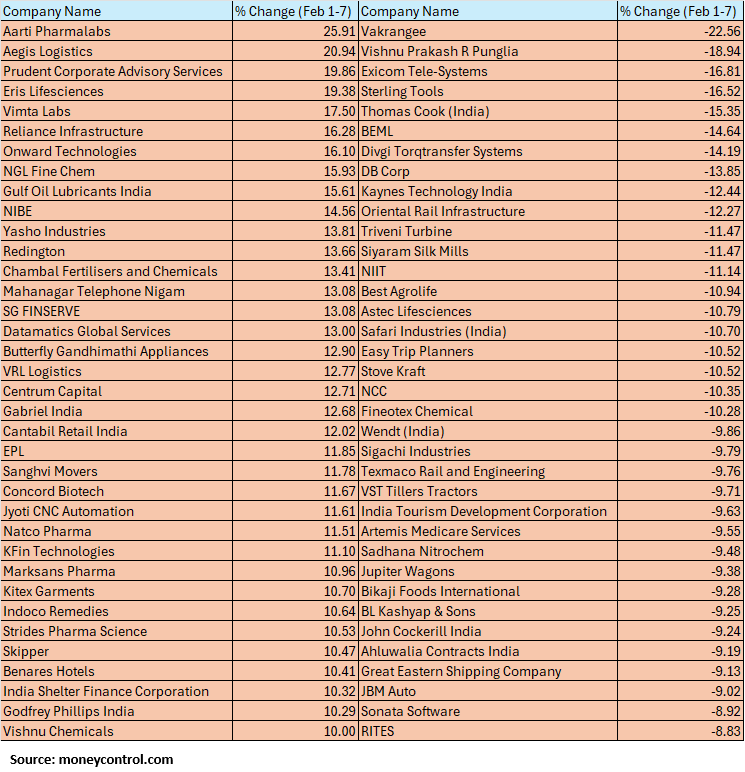

The BSE Smallcap Index was flat closed. Aarti Formalabes, Aegis Logistics, Prudent Corporate Advisory Services, Eris Lifestyle, Vomat Labs, Reliance Infrastructure, Onward Technologies, NGL Fine Cam, Gulf Oil Lubricants India gained 15-26 percent. While Vakrangi, Vishnu Prakash R. Pangalia, Exicom Tele-Systems, Sterling Tools, Thomas Cook (India), BEML, Divugi Tortransfered Systems, DB Corp, Keyne Technology India, Oriental Rail Infrastructure declined by 12-22 per cent.

How can market move ahead

Rajesh Bhosle of Angel One It says that the bullish gap around 23400 further, followed by handle low, can serve as a important support level at 23250 (Monday’s low level). Breaking below these levels can eliminate the existing up-move, which can return the Nifty 23000 and below. Despite many positive triggers, the Nifty seems to be struggling at the upper levels as the market has reached close to the upper range of the failing veg pattern. We have been monitoring this for the last few weeks. The lower end of this pattern is acting as the first support. While the upper end is now working as a rigorous resistance near 89 Dema.

Resistance levels remain at an interval of 100-cannac, including 23800 (Tuesday’s highest level), 23900 (89 DEMA), 24000 (200 DSMA) and 24250 (previous swing high levels). A strong bing is required to cross these levels. Till then, traders should book profits at regular intervals. The market may continue to be consolidated within 23250-23800 range in the near period and the breakout from this range can give a new direction to the market.

Disclaimer: The ideas given on Moneycontrol.com have their own personal views. The website or management is not responsible for this. Money control advises users to seek the advice of certified experts before taking any investment decision.