In RBI 2025 so far, the repo rate has reduced 1 percent i.e. 100 basis points. This has affected the EMI of home loan. EMI of millions of people has decreased. Now there is a big question in front of such people. The question is whether they should increase the loan soon by increasing their EMI or should invest extra money in shares?

The interest rate of home loan will also decrease due to decline by the repo rate by 1 percent

Rbi Repo rate for the first time in February this year (Repo Rate) 25 basis points reduced. The second time he reduced in April and the third time decreased early this month. The repo rate in three times has reduced by 1 percent. This made many banks their home loan (Home Loan) of EMI Has reduced Some banks are going to reduce soon. This means that now people who buy homes by taking home loans will have to pay less EMI every month than before. This will save money in their hands.

The duration of your loan will decrease if the interest of home loan decreases

This can be understood with the help of an example. Suppose a person has taken a home loan of Rs 50 lakh for 20 years. Its interest is 8.5 percent. The loan took place in January 2025. Now after the repo rate reduces 100 BPS, your bank will also reduce the interest rate of home loan. If the bank reduces your interest rate 100 bps, then the duration of your loan will be reduced to 206 months, so that you will have to pay less than Rs 14.78 lakh as an interest.

You can reduce EMI amount instead of lowering loan duration

If you want to reduce your EMI instead of reducing the bank loan duration, then your savings as interest will be relatively low. Instead of Rs 14.78 lakh, you will get a benefit of only Rs 7.12 lakh. This means that you are benefiting more by reducing the loan duration.

Benefits of repaying the loan before the scheduled time

Genith Finserv founder Anuj Kesarwani says that if people who have taken home loans soon want to repay the home loan, then they should not reduce EMI amount even after the interest rate decreases. But, if you want your EMI to decrease due to reduced interest rate and avoid more money in your hand, then you can ask the bank to reduce EMI.

You need to take a balance decision

Dev Ashish, founder of Stabilinweter, says that paying the home loan before the fixed period, a lot of money is saved on the interest. However, this should not be excessive emphasis on this. He says that it is necessary to create a balance between the loan prepament and other financial priorities. It is important to keep in mind that people’s opinion in this case may vary.

Your return will depend on where you invest

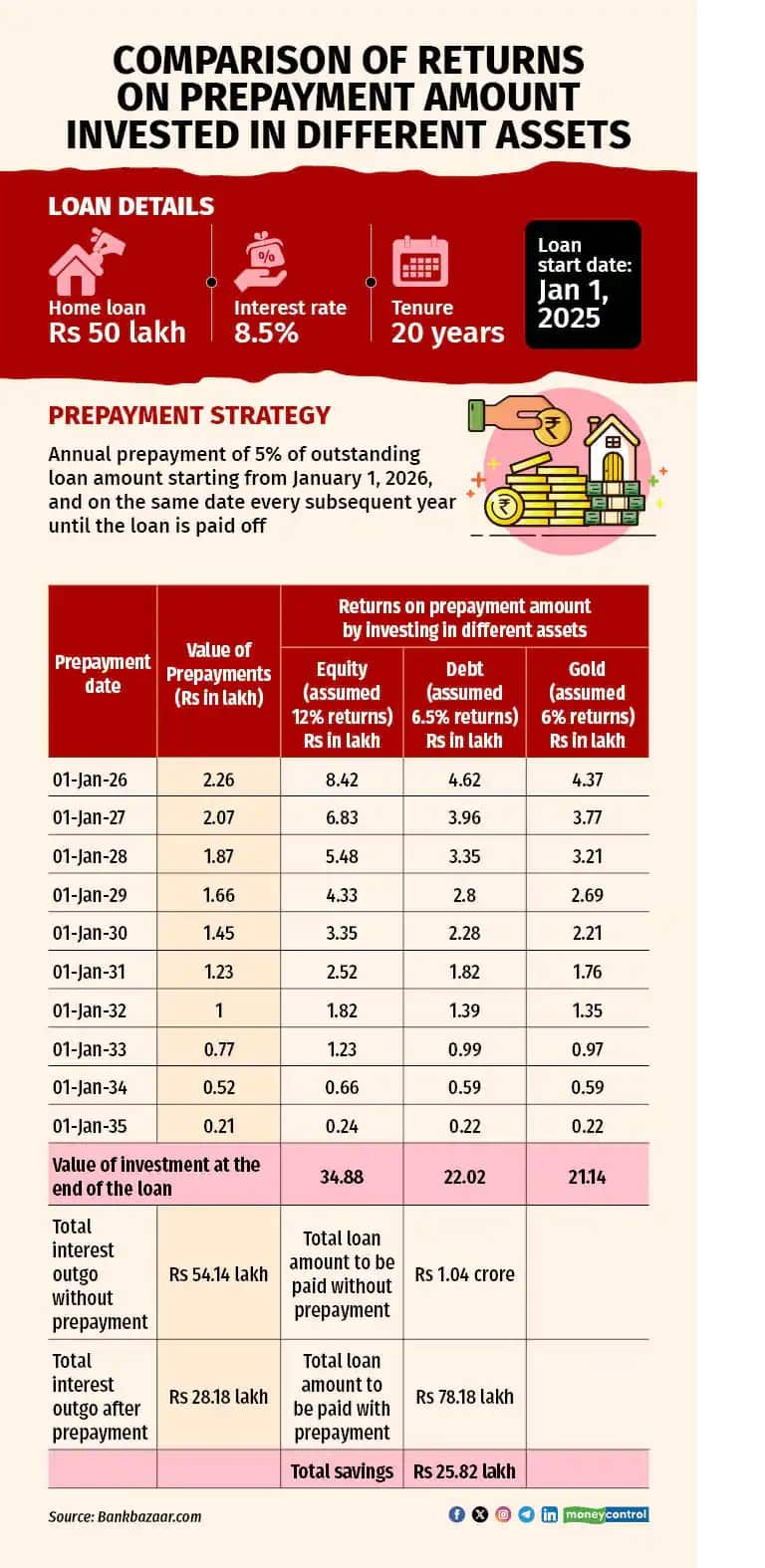

The return of the asset class in which you invest, instead of repaying the home loan ahead of time, your decision to invest extra money was correct or wrong. By looking at the table below, you can understand what will happen when investing the prepament amount in shares, bonds and gold.

Adil Shetty, CEO of Bankbazar.com, says that if you pay 5 % of the remaining money of your loan ahead of the scheduled time every year, then you have to pay 48 percent less money as an interest. He believes that investing the prepament amount can give you good returns, which is likely to be more than interest saving. The return depends on which asset you have invested. For example, by investing in shares, you will get more returns than investing in debt.

Investing in shares can get more returns

Ashish says that investing in shares can give 10-12 percent average returns in the long term. This is much higher than the interest rates of home loan. It is to be kept in mind that the return from shares is just based on estimates. This is not guaranteed.

Watch this video also: Warren Buffett’s 11 -year -old advice will save from trouble

If the return on investment in shares is more, then you will feel right to not repay before the time of home loan. But, if your return is less due to the decline in stock markets, then you may find your decision wrong. However, it is necessary to keep in mind that the return from shares in long term ie 10-12 is not less than 10-12 percent.

You can take the right decision according to your age

Ashish also says that the loan should be paid before the scheduled time or invests extra money in shares, it also depends on how old you are. If you are young and you have a lot of time left to invest, then the decision to invest additional money instead of repaying the loan ahead of time can be right for you. But, if you are close to retirement, then your decision to end the liability by repaying the loan before the scheduled time will be more correct.