Smallcap and midcap stocks are in the news. The decline in these stocks often begins with the statement of a big fund manager, a senior professor and a valuation expert. It is worth noting that there is no relation between such statements and decline in these shares. This can be a coincidence. However, due to this, the market starts nervousness. Retail investors get scared due to the news and discussion related to the stock market. When the market declines, the fear over investors dominates.

Many corrections have come in the market earlier also

Sell increases after fear increases. In this way the market declines (Market Fall) A bicycle of it becomes. Investors should understand that correction in the market (Market Correction) The first time has not come. Earlier, the market declined in 2008, 2013 and 2018. During this period, there was a more decline in midcap and smallcap stocks than the loudcap. This happens in every bicycle of decline. The second half of 2023 also worked about the increasing valuation of midcap and smallcap.

This time the decline starts with largecap stocks

This time the decline begins with largecap stocks. The decline in largecap stocks in late 2024 later took the smallcap and largecap stocks in their JD. Fundamentals and earnings have more effect on the prices of shares in short term. If the share prices have risen unilaterally, then they are sure to fall. The question is whether you should dominate you fear or keep your investment or buy new stocks?

Smallcap stocks more ups and downs

You need to understand the historical data of midcap and smallcap stocks. If you started investing in BSE Small Cap Index in January 2007 through monthly SIP. And if you had invested continuously till 2016, your annual return would have been around 5 percent. If it is extended a year forward, the annual return of the entire period increases to about 9 percent. This data gives a big thing to learn. Investment in smallcap stocks faces considerable ups and downs.

Smallcap index was up 50 percent in a year

The annual return of the BSE Smallcap Index between January 2007 and December 2016 was 5 per cent. Then, in 2017 it rose 50 percent in just one year. This means that if you cannot tolerate too much ups and downs or you cannot invest for more than 10 years, then you should not invest in smallcap stocks. Largecap stocks involved in your portfolio help reduce your portfolio loss when the decline in fixed income instruments and gold smallcap.

Also read: Markets are about to return good days, are you ready to take advantage of it?

Investment in smallcap for alpha returns

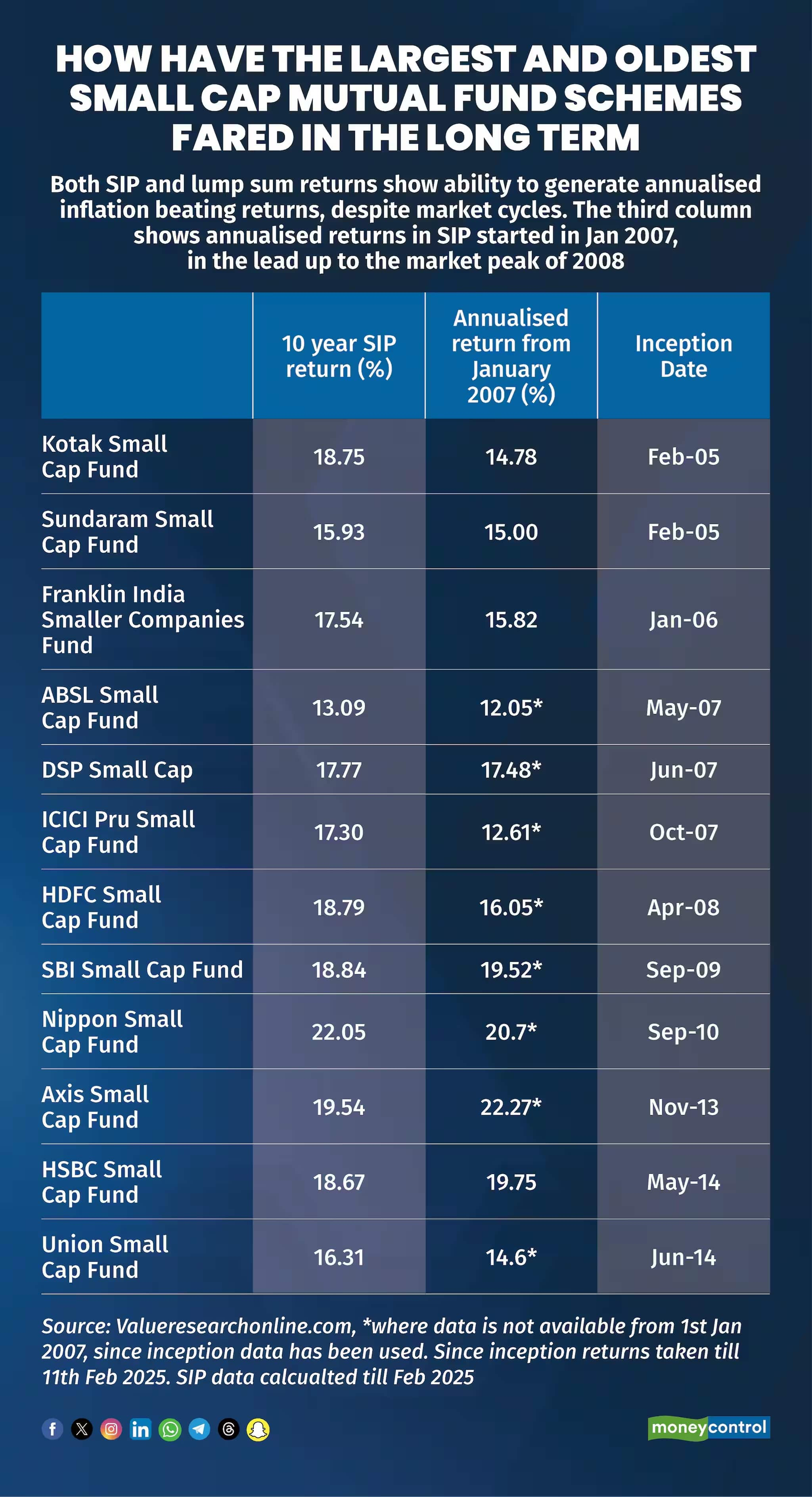

Fund managers choose good shares from these smallcap stocks to give alpha returns. If you see the return of 10-15 years of a mutual fund scheme, then you will see the return in the range of 12-22 percent. This is the reason why many investors and fund managers include smallcap stocks in their portfolio. One more thing to understand is that you should use SIP’s way to invest smallcap, midcap or lordCap. If your asset allocation is correct, then your portpolio will have a good performance. If you are going to sell stocks in Gabrat, then in the long term you will miss the opportunity to earn a hefty.