Dalal Street: Last week, the 30-share BSE Sensex fell 759.58 points or 0.98 percent. At the same time, the Nifty of National Stock Exchange (NSE) recorded a decline of 228.3 points or 0.97 percent. Now next week, the direction of Indian stock markets will be decided by the quarterly results of big companies like HDFC Bank, ICICI Bank, announcements after Donald Trump takes oath as US President and the activity of Foreign Portfolio Investors (FPIs). Analysts have expressed this opinion. Let us tell you that Trump will take oath as US President for the second term on Monday.

Experts’ opinion

“Markets are expected to remain cautious in the short term due to moderate expectations in the third quarter, while continued FII withdrawals may increase volatility,” said Vinod Nair, head of resources, Geojit Financial Services. According to him, the new US President’s policies and comments (especially on tariffs) will be closely monitored. He said that high inflation in Japan or strict policy of the Bank of Japan (BoJ) will also affect the market sentiment.

quarterly results

Even though Reliance Industries posted a 5 per cent rise with the announcement of healthy growth across key segments, Q3 performance has been mixed so far. Cautious comments from IT sector giants and below-expected performance by Axis Bank have affected the market sentiment. In such a situation, the market will keep an eye on the corporate earnings season starting next week. About 245 companies are going to declare their results next week. Big companies among them are HDFC Bank, Hindustan Unilever, Dr Reddy’s Laboratories, UltraTech Cement, JSW Steel, ICICI Bank and Bharat Petroleum Corporation.

Apart from this, other companies whose quarterly results are expected include Zomato, One 97 Communications Paytm, InterGlobe Aviation, Tata Technologies, L&T Finance, Dixon Technologies, Bank of India, IDFC First Bank, Yes Bank, IDBI Bank, Indian Railway Finance. Corporation, ICICI Securities, Jammu & Kashmir Bank, MCX India, Oberoi Realty, Dalmia Bharat, ICICI Prudential Life Insurance, India Cements, KEI Industries, PNB Housing Finance, South Indian Bank, UCO Bank, Coforge, Gravita India, HUDCO, Nuvoco Vistas Corporation, Persistent Systems, Pidilite Industries, Polycab India, Tata Communications, Adani Green Energy, Scient, Greaves Cotton, Hindustan Petroleum Corporation, Indian Energy Exchange, Indus Towers, Mankind Pharma, Mphasis, Nippon Life India Asset Management, Sona BLW Precision Forgings, Syngen International, United Spirits, DLF, Godrej Consumer Products, Jindal Saw, Torrent Pharmaceuticals, and Balkrishna Industries.

tariff phobia

Donald Trump will be sworn in as the 47th President of America on January 20. Along with this, policy announcements of his administration will also be made. Experts believe that these announcements can impact global market sentiment. During his last presidential term, Trump’s policies mainly focused on protecting domestic industries.

The rise in DXY and US bond yields is impacting FII flows into India. Therefore, the market will be closely watching FII activity. After heavy selling in the cash segment last year, 2025 also started with FII withdrawals. FIIs net sold shares worth over Rs 25,000 crore last week, taking their total outflow in January 2025 to Rs 46,576 crore (provisional figures). However, Domestic Institutional Investors (DII) supported the market. They bought shares worth Rs 49,367 crore in the month, almost offsetting FII selling.

oil prices

Rising crude oil prices is another important factor that the market will keep an eye on, especially for oil importing countries like India. Continuing its rally for the fourth consecutive week, Brent crude futures (the international oil benchmark) closed 1.29 per cent higher at $80.79 per barrel last week, its highest since July 2024. In fact, prices have moved above all major weekly moving averages (such as 10, 20, 50, 100 and 200-week EMAs), which give a positive signal.

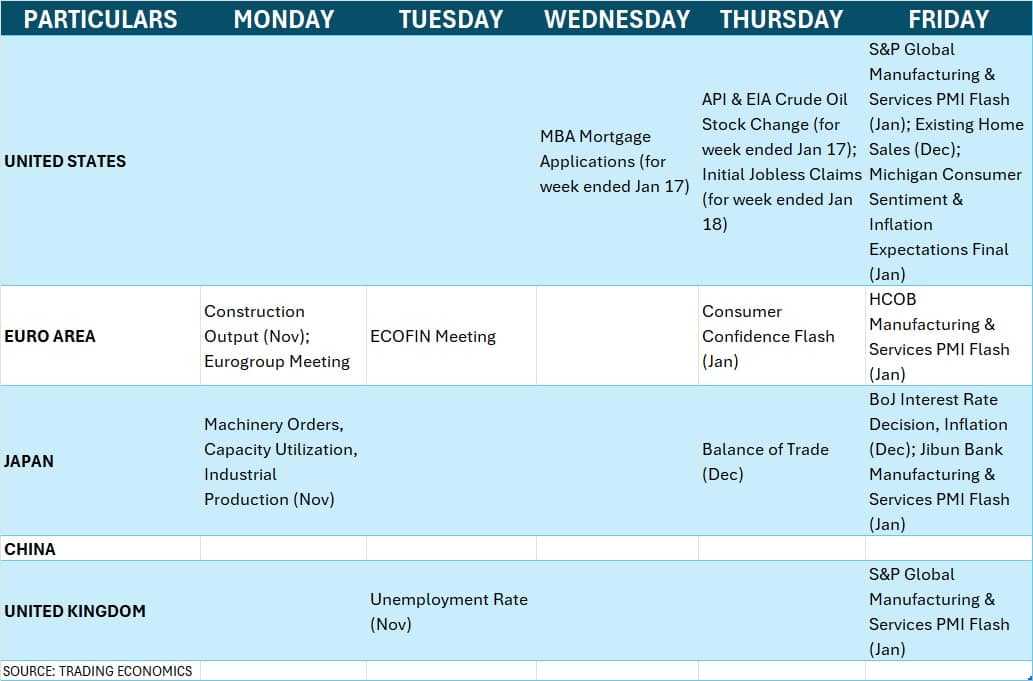

global economic data

In the coming week, the market will keep an eye on the interest rate policy of the Central Bank of Japan (BoJ) and the country’s inflation data. Apart from this, US Weekly Jobs data and January Manufacturing and Services Flash PMI data of many countries like US, UK, and Japan will also be important. These figures can play an important role in deciding the direction of the global market.

Domestic Economic Data

The direction of Indian markets will also be decided by the HSBC Manufacturing and Services PMI data for the month of January, which will be released on 24th of this month. Apart from this, the foreign exchange reserve data for the week ending January 17 will also be released on the same day, which may impact the market sentiment.

Forex reserves have been falling continuously since the last week of September, when it reached a record high of $704.885 billion. On January 10, reserves stood at $625.871 billion, which was also $8.714 billion less than on January 3. Experts attributed this steady decline to the forex market intervention as well as revaluation by the RBI (Reserve Bank of India) to help curb rupee fluctuations.

Last week, the rupee weakened 0.47 per cent and touched an all-time low of 86.69 against the dollar, but ended the week at 86.55 against the dollar. The rupee continued to decline against the dollar for the 11th consecutive week.

In the week starting from January 20, investors will have the opportunity to invest money in 5 new IPOs. Of these, only one Denta Water IPO is from the mainboard segment. The four other IPOs include CapitalNumbers Infotech, Rexpro Enterprises, CLN Energy and GB Logistics Commerce.

Apart from this, there will be an opportunity to invest money in 3 already opened IPOs in the new week, one of which is Stallion India IPO mainboard segment. Talking about listing, 7 companies are going to make their debut in the stock market in the new starting week.

technical view

Talking about technicality, Nifty 50 is looking weak. It is trading well below all major moving averages on the daily charts, and is also below the 10, 20 and 50-week moving averages. The index formed a doji candlestick pattern on the weekly chart, which shows confusion between bulls and bears in the market.

Consolidation is likely to continue in the market next week, where 23050 (last week’s low) will act as a key support zone. According to experts, if this level is broken decisively, a major selloff may begin in the market, due to which the index may fall to the level of 22800. On the upside, 23400 will act as an immediate resistance. If this resistance is crossed then 23700-23900 levels will be important in the market which will need to be monitored.

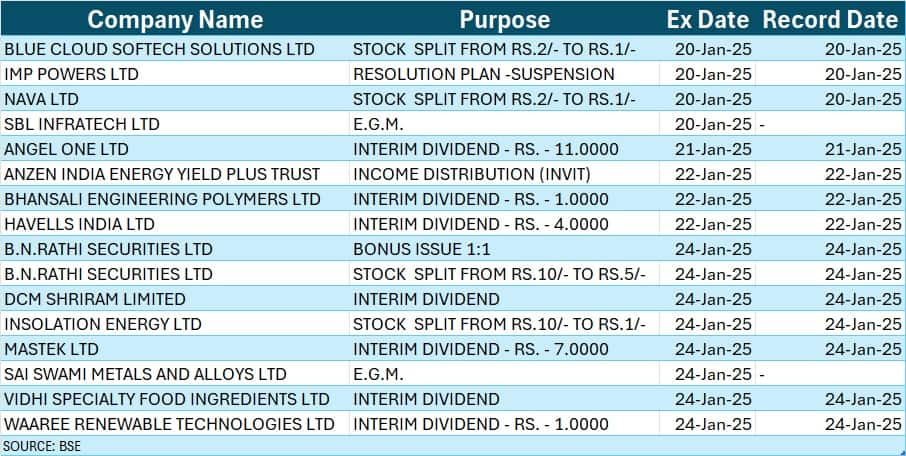

corporate action

Key corporate actions taking place in the coming week are as follows:

Disclaimer: The information provided here is being provided for information only. It is important to mention here that investing in the market is subject to market risks. As an investor, always consult an expert before investing money. Moneycontrol never advises anyone to invest money here.