Dalal Street: Last week, the 30-share BSE Sensex rose 657.48 points or 0.84 per cent, while the National Stock Exchange’s Nifty gained 225.9 points or 0.95 per cent. Now next week, the direction of Indian stock markets will be decided by the upcoming macroeconomic data, activities of Foreign Institutional Investors (FII) and global trends. Let us tell you that from this week a new calendar year and a new month will also begin. Investors will also keep an eye on the movement of the rupee, which on Friday suffered its biggest decline in almost two years, after which the rupee reached its lowest level ever.

Experts’ opinion

Vinod Nair, Head of Research, Geojit Financial Services, said, “Looking ahead, the market is likely to focus heavily on the upcoming third quarter results, which will play an important role in determining the direction of the market. “Investors will align their portfolios based on pre-Budget expectations.”

According to him, in the coming week, key figures like PMI data for India, US and China, as well as US jobless claims data will impact investor sentiment. He said the auto sector is likely to remain in the spotlight as volume growth expectations in December and improvement in valuations are supporting it.

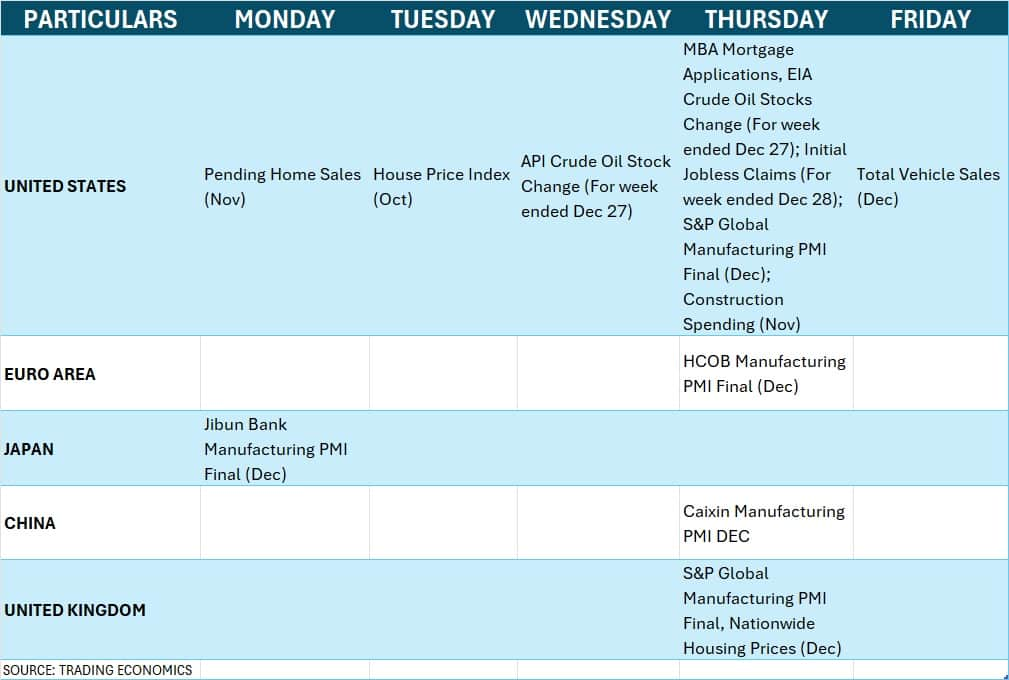

global economic data

Globally next week, investors will keep an eye on weekly jobs data and monthly vehicle sales data from the United States. Apart from this, the final manufacturing PMI numbers of several countries (including the US, Japan, China and the Euro Zone) in the last month of 2024 will also be monitored.

Domestic Economic Data

Domestically, fiscal deficit and infrastructure output data for November, as well as external debt data for Q3CY24, will be released on December 31. At the same time, the final data of HSBC Manufacturing PMI for December will be released on January 2. Manufacturing PMI rose to 57.4 in December from 56.5 in November, provisional numbers showed, indicating factory activity remained strong in the final month of the year.

Additionally, bank loan and deposit growth for the fortnight ended December 20 and foreign exchange reserves for the week ending December 27 will be released on January 3. Foreign exchange reserves further declined to $644.39 billion in the week ended December 20, which is $8.48 billion less than $652.87 billion in the previous week. There is a continuous decline in reserves from the record high of $ 704.89 billion in the week ending September 27 this year.

The focus will also be on auto sales figures for the final month of the current calendar year, which are scheduled to be released next week in early January. Hence, auto stocks including Tata Motors, Maruti Suzuki India, Ashok Leyland, Mahindra & Mahindra, Eicher Motors, Hero MotoCorp, Bajaj Auto, TVS Motor and Escorts Kubota will be in action next week. Most experts estimate that there will be single digit growth in sales of two-wheeler and passenger vehicle segments, along with good growth in tractor sales, but commercial vehicle sales are likely to be slow on an annual basis in December.

FIIs (Foreign Institutional Investors) remained net sellers last week also. They sold around ₹6,323 crore, taking the total outflow in the cash segment to ₹10,444 crore in December. This was the third consecutive month of net sales, but was significantly lower than October and November. However, they remained net buyers in the primary market.

High valuations as well as rise in US dollar and bond yields led to net selling by FIIs. They made net sales of Rs 2.97 lakh crore during the year. Experts expect FIIs to remain sellers in early 2025 given the rising US dollar index and bond yields, but thereafter their purchases will depend on economic growth and earnings.

DIIs, on the other hand, continued their purchases throughout the week, month and year. They bought shares worth ₹10,928 crore, ₹27,474 crore and ₹5.2 lakh crore, respectively, playing a strong role in offsetting the outflows from FIIs. Experts expect that investment by DIIs may increase further in 2025.

The Indian rupee touched its all-time low of 85.81 intraday on Friday and closed the week down 44 paise at 85.368, its all-time closing-low, on continued strong US dollar demand. The rupee fell 83 paise in December, the biggest monthly fall since May 2023. The rupee has fallen by Rs 2.2 in the current year, the biggest annual decline since 2022. The decline was mainly due to selling pressure from foreign investors in domestic equity markets, declining foreign exchange reserves and widening trade deficit.

Going forward, the focus will be on currency movements. Manoj Kumar Jain, Prithvifinmart Commodity Research, said, “We expect the rupee to remain volatile in the coming week amid fluctuations in the dollar index and domestic equity markets and it may trade in the range of 85.2200-86.4000 “

There will be less activity in the primary market in the week starting from 30th December. Reason, only 2 new IPOs are going to open. Of these, one is from the mainboard segment and the other from the SME segment. The last IPO in the mainboard segment this year will be of Indo Farm Equipment. Apart from this, there will be an opportunity to invest money in two already opened IPOs in the new week. Both these public issues are of SME segment. As far as listing is concerned, 6 companies are going to make their debut in the stock market in the new starting week.

technical view

Technically, Nifty 50 traded in the range of 23650-23950 last week and formed a small bullish candle on the weekly timeframe with upper and lower shadows indicating rangebound trading. This happened after the sharp fall in which Nifty had registered a long bear candle last week.

Experts believe that rangebound trading may continue in the coming week also, with resistance at the upper level at 24000, crossing which the index may move towards the zone of 24,300. On the downside, support will be at 23,650, below which the index may fall to 23,500. However, the overall sentiment remains bearish as the index is trading below the 10 and 20-week EMAs as well as the lower band of the Bollinger Bands.

According to derivatives data, Nifty 50 index may remain in the broad range of 23,500-24,500 in the coming week, as breaking any of these levels and holding on to it can give further direction to the market.

Talking about weekly options data, maximum open interest on the call side was seen at the strike price of 24,500, followed by the strike prices of 24,000 and 24,200. At the same time, call writing was maximum at the strike price of 24,200, followed by the strike price of 24,100 and 24,500.

On the put side, there is highest open interest at strike price of 23,500, followed by strike prices of 23,800 and 23,000. Talking about put writing, it was maximum at the strike price of 23,500, followed by the strike price of 23,000 and 23,900.

Volatility index, India VIX, fell sharply by 12.17 per cent to 13.24 during the last week, compared to a rise of 15.48 per cent in the previous week. This decline is a sign of relief for the bulls. If VIX remains below the 14 level, bulls may find it easier to maintain a strong position in the market.

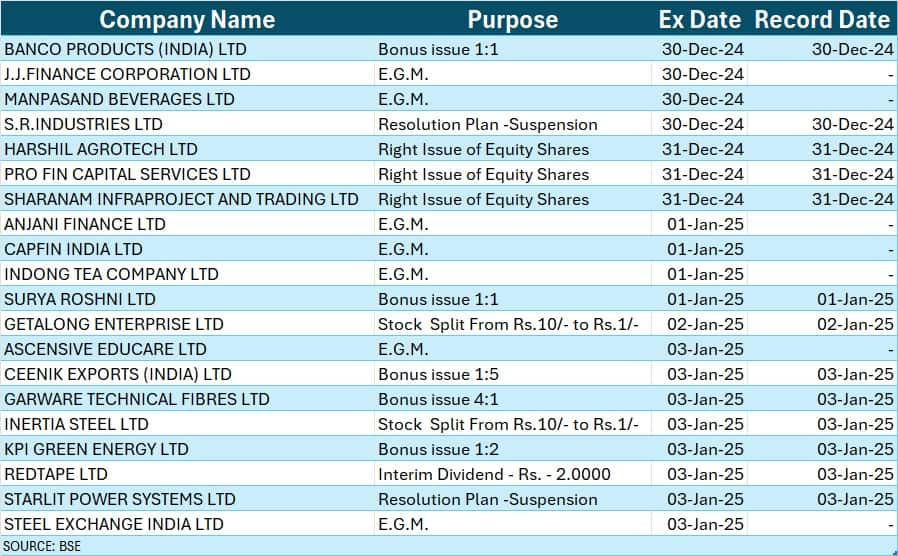

corporate action

Below are the key corporate actions taking place in the coming week:

Disclaimer: The advice or opinions expressed on Moneycontrol.com are the personal views of the expert/brokerage firm. The website or management is not responsible for this. Moneycontrol advises users to always seek the advice of a certified expert before taking any investment decision.