Dalal Street Week Ahead: Last week, the 30 -share Sensex of BSE gained 354.23 points or 0.45 per cent. At the same time, the National Stock Exchange’s Nifty was in profit of 77.8 points or 0.33 per cent. In this way, the market saw a boom for the second consecutive week. Now next week, the direction of the stock markets will be determined by inflation and other macro-economic data. Analysts have expressed the opinion that apart from this, the activities of foreign investors will also affect the market.

The market’s stance on Monday can depend on the Delhi election results announced on Saturday, where the BJP won. The market may remain rangebounds in the coming week, as investors will be eyeing the major macroeconomic data, including macroeconomic data (including CPI Inflation), American Inflation, Federal Reserve Chairman Jerome Powell’s statement, the remaining results of the third quarter and America Further announcements related to the tariff are included.

What is the opinion of experts?

Puneet Singhania, director of the brokerage firm Master Trust Group, said, “The upcoming week can be a fluctuations for global and Indian markets, where major macroeconomic data and corporate earnings will play an important role. Inflation figures, industrial output data and major The quarterly results of the companies will affect the market sentiment.

SVP-Research Ajit Mishra of Religare Broking advised investors to focus on stock selection based on sectoral trends. He said, “Most of the major sector rotational participation except FMCG is showing. However, it is necessary to be vigilant in the midcap and smallcap segment due to the instability in the broad market.”

Quarterly results

The earning season for the December quarter will end in the coming week. More than 2000 companies will announce their results this week. This includes Nifty 50 firms like Eicher Motors, Hindalco Industries, Apollo Hospitals and Grasim Industries.

Apart from this, Lupine, Siemens, FSN e-commerce ventures naika, Hanasa consumer, Ipka laboratories, national aluminum company, Bata India, Engineers India, Escorts Kubota, Patanjali Foods, Varun Beverages, Vodafone Idea, Astrazenka Pharma, Burjiti Paints, IRCTC, NBCC, Ashok Leyland, Bharat Forge, Power Finance Corporation, Jubilant Foodworks, Crumpton Greaves Consumer Electricals, Hindustan Aeronautics, Muthoot Finance, Facon’s Infrastructure, Manappuram Finance, United Brux, United Brokements, Gleanmark Pharmaculars, Bills Dr. Agrawals The Eye Hospital and Narayan Hridayalaya will also result in quarterly results.

CPI Inflation

Investors will also keep an eye on the figures of CPI Inflation of January, which are going to be released on 12 February. CPI Inflation is one of the important factors for RBI to decide at interest rate. Its December 2024 is expected to decrease to 5.22 per cent in January 2025, more than 5.22 per cent. It has been decreasing since crossing 6.21 per cent in October 2024.

The data of industrial and manufacturing production of December will also be announced on this day. WPI Inflation for January 14, bank loan for fortnight ended January 31, and deposit growth figures for the fortnight and Foreign Exchange Reserve figures for the week ended 7 February.

Us infection

Globally, market eyes will be on the US inflation data, PPI, retail sales and January industrial production data. Most economists hope that the January inflation rate will remain stable at 2.9%, which will be the same as December 2024 levels.

Fed Chair Powell’s testimony

The testimony of Federal Reserve Chair Zerome Powell will be an important event for global markets. For the first time after July 2024, Powell will submit a report on the economic approach to the MPs next week and the recent monetary policies, after which they will be questioned. Powell will testify to the Senate Banking Committee on 11 February and the House Financial Services Panel (Finance Committee) on 12 February.

Since July 2024, Fed has cut interest rates in three meetings by a total of 100 basis points. At the January 2025 policy meeting, Fed kept the rates stable at 4.25–4.5% and indicated that there is no hurry about further cuts.

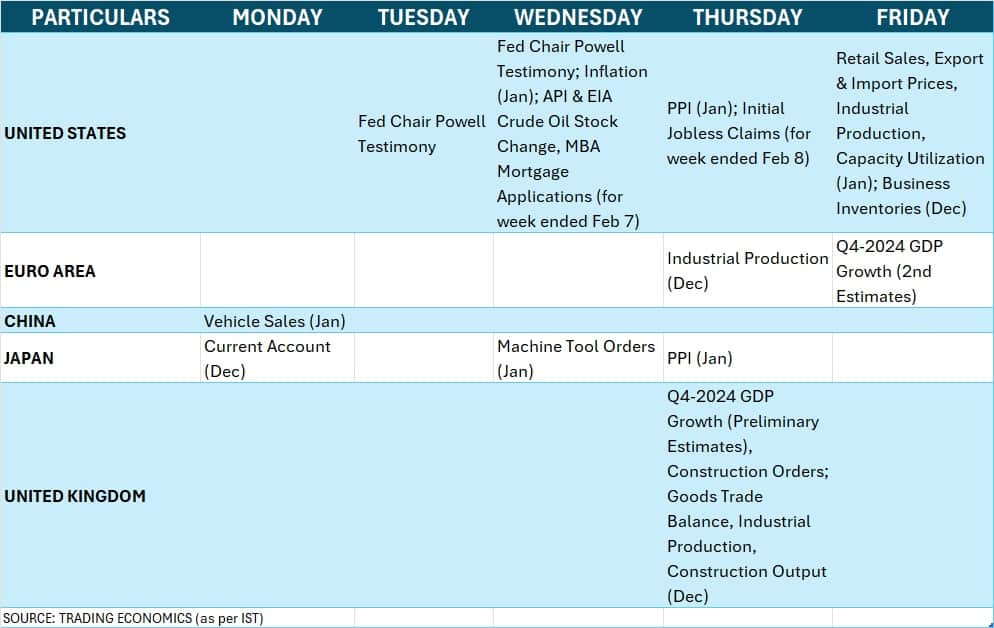

Global Economic Data

In addition to the US inflation and testimony to the Fed Chair, the Q42024 GDP estimate of Europe and UK will also be monitored and China’s January vehicle sales figures will also be monitored.

oil prices

Crude oil prices will be monitored, as the decline in it is proving beneficial for importing countries like India. Brent crude futures, which is a benchmark of international oil prices, closed down the third consecutive week. It fell at $ 74.66 per barrel last week after moving above $ 80 per barrel last month. Prices have come down from all major moving averages, strengthening the bearish sentiment, which is a positive signal for India.

The activities of foreign and domestic institutional investors will also be monitored. So far in February, FII has sold a net selling of more than ₹ 10,000 crore. Earlier, in January, he sold shares worth ₹ 87,375 crore. The major causes of this selling include strong dollars and the American bond yield.

However, domestic institutional investors (DII) balanced FII’s selling to a great extent. So far in February, DII has made a net purchase of ₹ 7,274 crore in the cash segment. In January, he bought shares worth ₹ 86,592 crore (Provisional Numbers). FII remained a net seller for the fifth consecutive month, while DII has been a pure buyer since August 2023.

A total of 9 IPOs are going to open for investors from 10 to 15 February next week. 3 of these are of IPO mainboard. There are 6 SME IPOs. Along with this, the list of 6 companies is also going to be held in the stock market next week. The three IPOs that will open in the mainboard segment include Ajax Engineering, Hexaware Technologies and Quality Power Electrical Equipments. In the SME segment, Chandan Healthcare, PS Raj Steels, Voler Car, Maxvolt Energy Industries, Lk Mehta Polymers, and Shanmuga Hospital will launch their IPO next week.

Technical view

Consolidation may be seen in the Nifty in the coming week, until it trades below 23,800, which is an important hurdle for the rally up to 24,000-24,200 zones upwards. Support is on 23400 (50-Veek EMA), followed by 23250 (last week’s low).

Overall, the market is the sentiment positive, as a bullish candlestick pattern is made with upper shadow on the weekly chart, which shows some pressure at the upper levels. Last week, a bullish anglefing pattern was formed, with a higher high and higher low, and the volume was also more than the average. If the Nifty decishes the level of 23,250 decisively, the higher top-hier bottom formation may be interrupted, which can weaken the bullish trend.

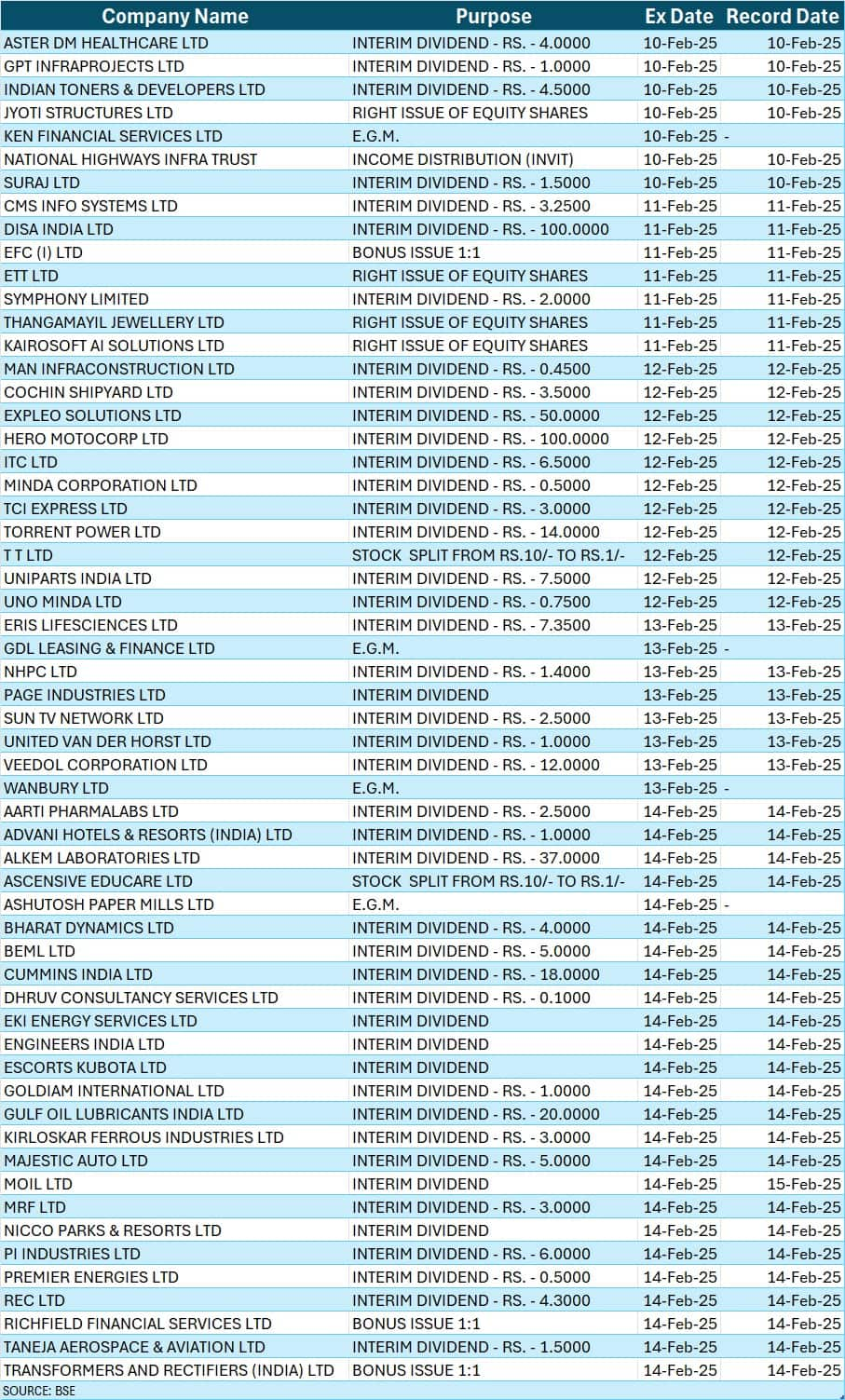

Corporate action

The major corporate action to be held in the coming week is as follows:

Disclaimer: Advice or idea experts/brokerage firms on Moneycontrol.com have their own personal views. The website or management is not responsible for this. Moneycontrol advises to users that always seek the advice of certified experts before taking any investment decision.