Market Next Week: Broader indices underperformed the benchmark indices. Due to this, the market closed flat in the holiday week ending December 27. This week, BSE Sensex closed at 78,699.07, up 657.48 points or 0.84 percent. While the Nifty 50 index closed at 23,813.40, up 225.9 points or 0.95 percent. Among sectoral indices, Nifty Auto and Pharma indices rose more than 2 per cent each. The Nifty FMCG index rose 1.5 percent. While Nifty Bank and Realty increased by 1 percent. On the other hand, Nifty Media index declined by about 2 percent and Nifty Metal index declined by 1 percent.

Foreign Institutional Investors (FIIs) increased their selling during the week. They sold equities worth Rs 6,322.88 crore. While Domestic Institutional Investors (DIIs) supported the Indian market. They sold equities worth Rs 10,927.73 crore. Bought equity.

So far this month, FIIs have sold equities worth Rs 10,444.10 crore. Whereas DII has purchased equity worth Rs 27,474.14 crore.

Kotak Securities’ Amol Athawale’s opinion on next week’s market

Amol Athawale of Kotak Securities said “The past week witnessed lackluster action in the benchmark indices. Nifty rose 1 per cent while Sensex gained 650 points. During the week, the market experienced non-directional action. Nifty was on the downside, 23650 and Sensex got support near 78100 while Nifty/Sensex had 200-day simple moving average. Profit booking took place near (SMA) or 23860/78800.

“Technically, a small inside body candle is visible on the weekly chart. This pattern is showing non-directional activity on the daily and intraday charts. This is indicating indecision between the bulls and bears,” he said.

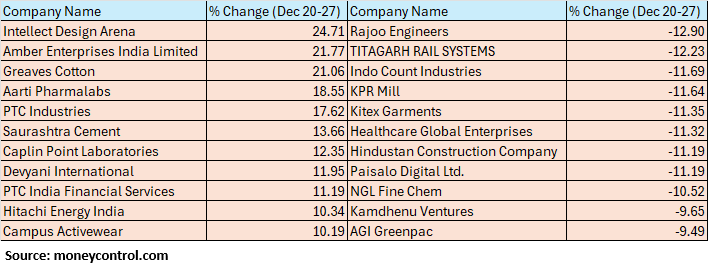

BSE small-cap index closed flat. These include shares of Intellect Design Arena, Amber Enterprises India, Greaves Cotton, Aarti Pharmalabs, PTC Industries, Saurashtra Cement, Caplin Point Laboratories, Devyani International, PTC India Financial Services, Hitachi Energy India, Campus Activewear, Triveni Engineering & Industries. An increase of 24 percent was seen.

On the other hand, shares of Raju Engineers, Titagarh Rail Systems, Indo Count Industries, KPR Mill, Kitex Garments, Healthcare Global Enterprises, Hindustan Construction Company, Paisalo Digital, NGL Fine Chem saw a fall of between 10-13 percent.

How could Nifty move next week?

HDFC Securities’ Nagraj Shetty’s opinion on the market for Monday 30 December

Nagaraj Shetty said that the short term trend of Nifty is slightly positive with rangebound action. The market may face strong overhead resistance around 24000-24200 levels till next week. Any rise up to these resistances could be a sell-on-rise opportunity. On the other hand, immediate support is visible in the index at 23650.

Hrishikesh Yedve of Asit C. Mehta Investment on the market for Monday 30th December

Yedve said that technically, Nifty managed to surpass the 200-day simple moving average (200-DSMA) on the daily chart but failed to sustain above it. This created a doji candle in it. On the weekly chart, the index has formed an inside bar candlestick pattern. This pattern is indicating strong demand near 23,500-23,540 zone.

200-DSMA in Nifty is seen around 23,860. This level will act as immediate resistance for Nifty. A decisive move above this level could take the index to 24,000-24,100.

With Nifty moving lower, 23,500 remains an important support. In the near term, Nifty is expected to consolidate between 23,500 and 23,900. In this, only a breakout on either side will decide its next move.

(Disclaimer: The views and investment advice expressed on Moneycontrol.com are the personal views and opinions of investment experts. Moneycontrol advises users to consult certified experts before taking any investment decision.)