RBI Repo Rate Cut: The Reserve Bank of India (RBI) Monetary Policy Committee (MPC) announced a repo rate cut on 7 February today after a long gap of nearly 5 years. RBI Governor Sanjay Malhotra said that the committee has decided to reduce the repo rate by 0.25 per cent. With this, the new repo rate has now come down from 6.50 percent to 6.25 percent. Malhotra said that economic conditions at the global level are still challenging, but there has been a little stagnation in inflation at the global level.

After the repo rate cut, Moneycontrol has prepared a list of 11 stocks with the help of experts, which can show good returns in short-term. Let’s know about these stocks-

Expert: Ashish Kyal, Founder and CEO of Webs Strategy Advisors

1. Bajaj Finance

Bajaj Finance gave a breakout from the triangle formation on 29 January and has been seen continuously. In addition, prices in the last few sessions have been successful in saving the lower level of the previous day, which reflects the strength of the current trend. On the Daily Chart, prices are closing close to the upper bolling band from the last 9 consecutive trading sessions, a positive signal. However, after this rapid phase, the RSI (Relative Strength Index) is now trading near the overbott zone, indicating that prices may need to stay a little stay or take a correction before proceeding.

Therefore, instead of shopping at high levels, shopping on the decline will be a more intelligent decision. Overall, the trend of Bajaj Finance is Bulish. Shopping will be a better strategy on the decline from the current level.

Advice: Buy

Target Price: ₹ 8,850, ₹ 9,200

Stop-Loss: ₹ 8,100

2. Ujjivan Small Finance Bank

The stock was trading in the Rectangular Range for the last few days, which shows acuity in stock. After the breakout from this range, prices resumed the neckline and saw a sharp jump in the previous trading business. On the daily chart, the stock is trading over the Ichimoku cloud, indicating that its trend bullish remains in the short-term. A decline from ₹ 38 to Rs 38.30 can be seen as a purchase opportunity.

Advice: Buy

Target Price: ₹ 41, ₹ 42

Stop-Loss: ₹ 37

3. Ganesh Housing Corporation

Ganesh Housing Corporation is trading in an upward sloping channel (upward channel) from October 2024, which shows the strength of the current trend. Since 4 February 2025, the stock is closing above its previous high every day, making the bullish sentiment. In addition, after getting support from Ichimoku Cloud, the stock recorded further, which suggests that the bullishness is increasing. The stock is currently trading near its previous swing high (₹ 1,485). MACD has given a bullish crossover and trading over the zero line, indicating that the trending move may continue.

Advice: Buy

Target Price: ₹ 1,560, ₹ 1,630

Stop-Loss: ₹ 1,420

Expert: Research Head of Anshul Jain, Laxmishree Investments

4. Maruti Suzuki India

Maruti Suzuki is creating a 131-day bullish cup and handle pattern, indicating strong upset capacity. The breakout above Rs 13,130 can trigger the rally to Rs 13,800, making it attractive to shopping. If the Momentum persists, the stock may see a strong boom.

Advice: Buy

Target Price: ₹ 13,800

Stop-Loss: ₹ 12,900

5. Indusind Bank

The IndusInd Bank has broken a falling trendline and gave a breakout, after which the stock is getting stronger. On Thursday, an inside bar pattern is indicated that the stock may soon give a strong breakout move. Given the current trend and building momentum, there is a possibility of a strong upward move in the IndusInd Bank.

Advice: Buy

Target Price: ₹ 1,125

Stop-Loss: ₹ 1,050

6. ICICI Bank

The ICICI bank is indicating potential boom after the bank flag breakout. The stock has made two ‘inside bar’, pointing to a strong boom move.

Advice: Buy

Target Price: ₹ 1,330

Stop-Loss: ₹ 1,255

Expert: Riank Arora, Technical Research Analyst of Mehta Equities

7. State Bank of India (State Bank of India)

SBI has touched an important trendline support level at Rs 752, which is indicating momentum and strength at the lower levels. Its 14 days of RSI is around 42, indicating sideways Momentum, but a good risk-working ratio makes this stock attractive at current levels.

Advice: Buy

Target Price: ₹ 785

Stop-Loss: ₹ 735

8. HDFC Bank (HDFC Bank)

HDFC Bank has given a strong breakout above the resistance level ₹ 1,733 of the anchor VWAP (Volume Watched Average Price) and has closed firmly above this level.

Advice: Buy

Target Price: ₹ 1,800

Stop-Loss: ₹ 1,715

Expert: Vidyan Sawant, GEPL Capital Hod (Research)

9. Kotak Mahindra Bank

Kotak Mahindra Bank has created higher bottles on a weekly chart, indicating improvement in trends. For the last two weeks, the stock has been over its sloping trendline, which was drawn from the multi-age high of 2021. On the Daily Chart, the stock is now being consulted after creating a strong bullish gap in January 2025. Stock is trading near 12-DEMA (12-day experienced averages), an important short-term support. At the same time, its RSI (Relative Strength Index) is at 60 levels, which shows the Bulish Momentum.

Advice: Buy

Target Price: ₹ 2,127

Stop-Loss: ₹ 1,801

10. City Union Bank (City Union Bank)

City Union Bank has continued to create a higher bottom on the weekly chart from April 2024, indicating a rapid trend. Its RSI is currently at 53, which indicates the Momentum being better.

Advice: Buy

Target Price: ₹ 203

Stop-Loss: ₹ 162

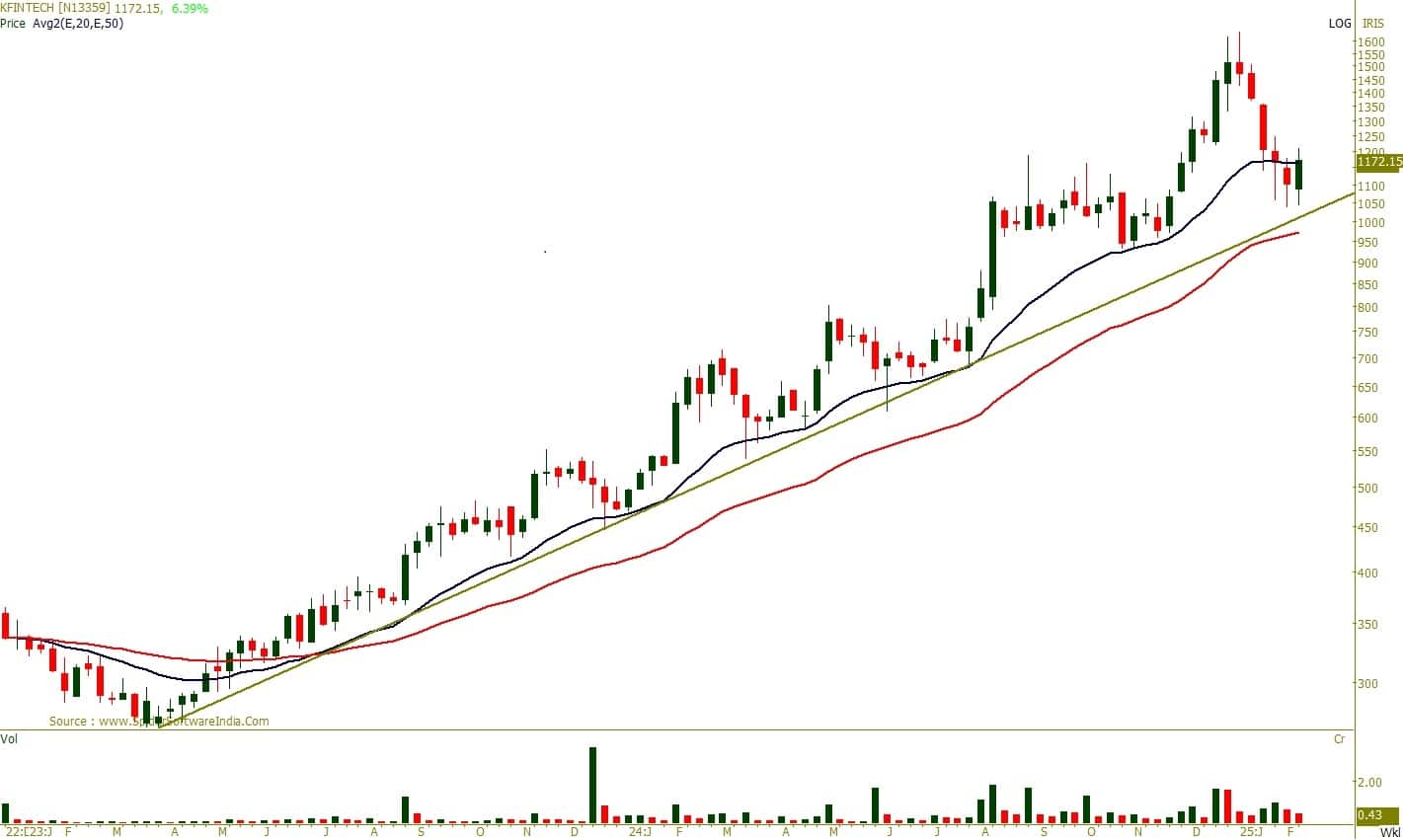

11. Kfin Technology

The stock has been constantly making Higher High and Higher Bottom since March 2023 and during its trend has been strong upwards. There are signs of continuing uptrend to continue further

Advice: Buy

Target Price: ₹ 1,406

Stop-Loss: ₹ 1,078

Also read- These 10 shares including Trent, ITC can get up to 52% return, know their target price from brokerage

Disclaimer: The ideas and investment advice given by experts/brokerage firms on Moneycontrol are their own, not the website and its management. Moneycontrol advises users to consult a certified expert before making any investment decision.