Market This Week: The broad indices performed in line with the benchmark indices. The trend of decline continued for the second consecutive week. Mid and smallcap indices fell by 0.5-1 per cent. This week, the BSE Sensex closed at 76,619.33, down 759.58 points or 0.98 per cent, while the Nifty 50 index closed at 23,203.20, down 228.3 points or 0.97 per cent.

However, among broader indices, BSE Mid-Cap and BSE Small-Cap indices fell by 1 per cent each, while BSE Large-Cap index fell by 0.5 per cent.

Talking about sectoral indices, Nifty IT index fell by about 6 per cent, Nifty Realty fell by 2.5 per cent, Nifty Healthcare, Media, FMCG index fell by more than 2 per cent. At the same time, Nifty PSU Bank and Metal index increased by 3 percent.

Foreign institutional investors (FIIs) sold equities worth Rs 25,218.60 crore during the week, while domestic institutional investors (DIIs) bought equities worth Rs 25,151.27 crore. However, so far this month, FIIs have sold equities worth Rs 46,576.06 crore and DIIs have bought equities worth Rs 49,367.14 crore.

Shrikant Chauhan, Equity Research Head, Kotak Securities Said that last week Nifty and Sensex fell by 1 percent. Even the mid-cap index and small-cap index declined by about 1 per cent each last week. Even good Q3 earnings for large cap stocks failed to improve market sentiment amid gains in crude oil prices last week (+5%) and continued rupee depreciation (-0.6%).

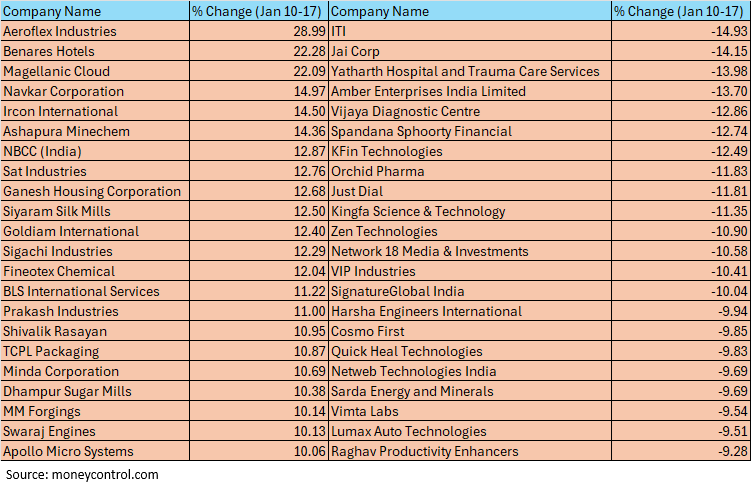

The BSE Smallcap index fell 6 per cent, with shares of Jai Corp, KEC International, Inox Wind, Skipper, Oriental Rail Infrastructure, Garware Hi-Tech Films, Blue Star, PCBL falling 15-23 per cent. However, Spandana Spurthi Financial, PTC Industries, Coffee Day Enterprises, Vijaya Diagnostic Center and Pokharna gained between 10-19 per cent.

How can the market move in future?

Amol Athawale of Kotak Securities says that technically on daily and intraday charts Nifty still remains at lower levels indicating further weakness from the current levels. The current market structure is weak, but it is also oversold. Therefore, levv based trading would be the ideal strategy for short term traders.

23300/76900 will act as an important resistance level for the bulls. Above this level, we may see a pullback rally towards 23500/77500 and 23590/77800, or 20-day Simple Moving Average (SMA). On the other hand, 23100/76300 will act as an important support zone. Below this level the market may slip to 23000/76000. Further weakness could potentially drag Nifty towards 22850/75700.

Talking about Bank Nifty, as long as it is trading below 49200, the weak sentiment is likely to continue. On the downside, it may touch 48000-47600 levels. However, if it manages to move above 49200 then chances of reaching 49800-50000 will increase significantly.

Market outlook: Sensex-Nifty closed with a decline, know how their movement may be on January 20

Nagaraj Shetty of HDFC Securities Says that on the weekly chart Nifty has formed a small bullish candle with minor upper and lower shadow. Technically this is a signal for the formation of the weekly market action doji candle pattern. Usually, confirmation of a Doji pattern after a good correction is a signal of a possible reversal.

The short term trend of Nifty remains weak amid range movement. A decisive bounce above 23400 could fill the market with fresh buying enthusiasm. Immediate support for Nifty is visible at 23100.

Jatin Gedia, Technical Research Analyst at Mirae Asset Sharekhan Says Nifty may slip downwards towards psychological level of 23000. If the support of 23000 is broken, a fall to 22670 is possible. At the same time, if there is success in dealing with the selling pressure, then Nifty may be seen consolidating in the range of 23100 – 23300.

Disclaimer: The views expressed on Moneycontrol.com are the personal views of the experts. The website or management is not responsible for this. Money Control advises users to seek the advice of a certified expert before taking any investment decision.