Market News: The Broader indices remained under pressure for the third consecutive week. Broader indices also underperformed compared to benchmark indices amid mixed Q3 results and continued selling by FIIs. This week, the BSE Sensex fell 428.87 points or 0.55 per cent to close at 76,190.46, while the Nifty 50 index fell 111 points or 0.47 per cent to 23,092.20.

Among individual sectors, Nifty Realty index fell by 9 per cent, Nifty Energy index fell by 4 per cent, Nifty Media and Oil & Gas fell by 4.5 per cent. However, the Nifty IT index gained 3.5 per cent and the Nifty FMCG index rose 0.5 per cent.

Foreign institutional investors (FIIs) were net sellers during the week. Because he sold equity worth Rs 22,504.08 crore. While domestic institutional investors (DIIs) bought equity worth Rs 17,577.36 crore. However, so far this month, FIIs have sold equities worth Rs 69,080.14 crore, while DIIs have compensated by buying equities worth Rs 66,944.50 crore.

US Market: Wall Street remains sluggish amid mixed economic data and company results

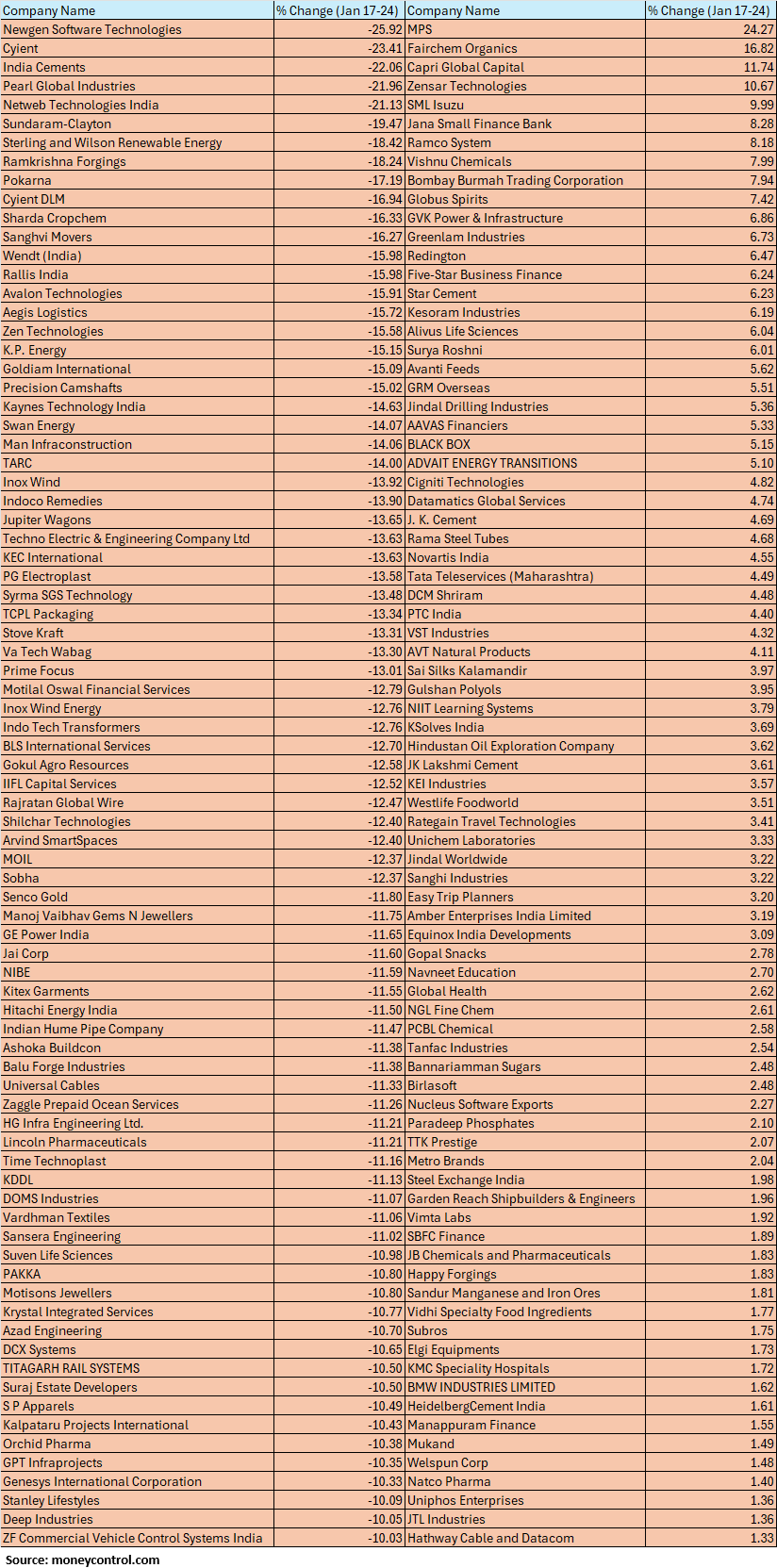

The BSE Smallcap index fell 4.2 per cent, led by Newgen Software Technologies, Cyient, India Cements, Pearl Global Industries, Netweb Technologies India, Sundaram-Clayton, Sterling & Wilson Renewable Energy, Ramakrishna Forgings falling 18-26 per cent. However, MPS, Fairchem Organics, Capri Global Capital, Gensar Technologies, SML Isuzu, Jana Small Finance Bank, Ramco System, Vishnu Chemicals, Bombay Burma Trading Corporation, Globus Spirits gained 7-24 per cent.

How could the market move next week?

Rupak Dey, Senior Technical Analyst, LKP Securities It says that in the short term, unless Nifty fails to cross the level of 23,450, bears may continue to dominate the market. Any move towards 23,350-23,450 zone may bring selling pressure from above. However, as long as the support of 23,000 holds, the downside may be limited.

Nagaraj Shetty of HDFC Securities Says that the near term trend of Nifty remains weak. Fall below the immediate support level of 22975 may lead to next decline towards 22800 levels. Any bounce towards 23350-23400 could be a good selling opportunity on upside.

Hrishikesh Yedve, AVP Technical and Derivatives Research, Asit C. Mehta Investment Intermediates It is said that from a technical point of view, on the daily scale, Nifty has formed a red candle indicating weakness. However, the index managed to save the recent swing low of 22,980. As long as the index holds 22,980 levels, a short term pullback towards 23,300-23,400 may be possible. On the other hand, sustaining below the recent swing low of 22,980 may lead to weakness towards 22,850-22,800 levels. On the upside, there is resistance at the 250-day simple moving average (250-DSMA) located around the 23,600 level. At this time, it would be advisable to adopt the strategy of selling on the rise in Nifty.

Disclaimer: The views expressed on Moneycontrol.com are the personal views of the experts. The website or management is not responsible for this. Money Control advises users to seek the advice of a certified expert before taking any investment decision.